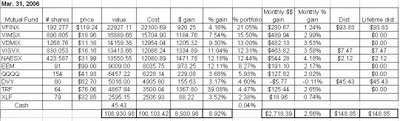

The value of the metals within several U.S. coins, including pennies and nickels, now exceeds the face value of the coins, as shown in the picture below that I acquired from coinflation.com, the best website I've seen for determining the intrinsic metal of various coins (click on the picture for a larger view). As one can see, the metal value of pre-1982 pennies is now 2.0752 cents (207.52% of face value), post-1982 zinc pennies have a metal value of 1.1257 cents (112.57% of face value), and nickels have a metal value of 6.9879 cents (139.75% of face value).

To realize the intrinsic metal value of these coins, one would need to melt them down to separate out the respective valuable metals. Up until yesterday, my understanding was that this practice was not illegal. I've never done so myself or heard of anyone actually doing so, but I read somewhere that this practice would not be prohibited.

The U.S. Mint has apparently been losing money by making pennies and nickels over the past year as it pays more for the metals used to make the coins that it receives in return when it sells the coins at face value to banks, etc. As of today, the U.S. Mint has made it illegal to melt down pennies and nickels. It is also illegal to transport more than $100 worth of pennies and/or nickels out of the country unless it is for legitimate coinage purposes. The penalty for violation of this new rule is a penalty of up to five years in prison and a fine of up to $10,000 for people convicted of violating the rule.

In case anyone had any doubts about whether collecting pennies and nickels is worthwhile, the U.S. Mint's implementation of the new rule should quell such doubts. It's only a matter of time until the U.S. Mint changes the metal composition of pennies and nickels to include less expensive metals, a move that would likely increase the collectible value of current pennies and nickels.