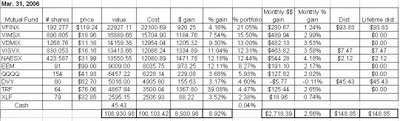

Small caps were my best performers, with the Vanguard Small Cap index fund (NAESX) leading the gains with a rise of 4.18%, and the Vanguard Small Cap Value index fund (VISVX) rising 3.58%. My diversified international index fund, the Vanguard Developed Markets index fund (VDMIX) also performed well, rising 3.53%.

However, March was not a particularly great month for the holdings paying substantial dividends. As shown in the table below, iShares Dow Jones U.S. Select Dividend Index Fund (DVY) lost 0.11% in March, and the SPDR financial component index ETF gained only 0.74%. Financials are a major component of DVY, so perhaps the relatively flat yield curve is an explanation as to why the financial stocks performed so poorly in March.

Four of the holdings in my Hypothetical Model Portfolio paid dividends in March. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or a closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The reason I am doing this is because the index mutual funds in this portfolio do not charge a transaction fee for reinvesting dividends. To reinvent dividends for any of the ETFs or TRF, on the other hand, would cause me to incur transaction fees for the trading commissions. Since the dividend on DVY was only $45.43, paying a $5 commission to purchase more shares would not make sense.

The Vanguard S&P 500 index fund (VFINX) paid a dividend of $0.49/share (a total of $93.83) which was reinvested on March 17 to purchase an additional 0.780 shares at a price of $120.35/share. VISVX paid a dividend of $0.009/share (a total of $7.47) which was reinvested on March 17 to purchase an additional 0.467 shares at a price of $15.98/share. NAESX paid a dividend of $0.005/share (a total of $2.12) which was reinvested on March 17 to purchase an additional 0.068 shares at a price of $31.40/share. DVY paid a dividend of $0.56787 on March 20 (a total of $45.43) which was moved to "CASH" on the table shown below.

No comments:

Post a Comment