Thursday, June 29, 2006

Emigrant Direct Raises Its Money Market Interest Rate to 4.80%

I just saw an online advertisment for Emigrant Direct which indicates that they have raised their money market interest rate to 4.80%. I'm not sure if they raised their money market interest rate today, but it must have happened sometime within the past few days. Emigrant Direct now pays more than half a percent more than INGDirect, which currently pays a paltry 4.25%.

Tuesday, June 27, 2006

Robert Kiyosaki Has Written Another Flimsy Article For Yahoo Finance

Robert Kiyosaki has once again written an article for his Yahoo Finance column that has gotten me all riled up. (See my previous post - "Robert Kiyosaki Is A Blowhard.") This one is entitled “Why Mutual Funds Are Lousy Long-Term Investments.”

He basically attempts to argue that mutual funds are wastes of money because of the fees they charge. He borrows quite a bit from an interview given by Vanguard founder John Bogle in which Bogle mentioned that mutual funds charging high fees are doing a disservice to most investors because the investors take 100% of the risk, put up 100% of the amount to be invested, but over time make quite a bit of money for the companies offering the mutual funds.

That’s fine and I do not disagree with that allegation. Bogle thinks that actively managed funs generally charge too much and that most investors would instead be better served investing in index-tracking funds. I also agree with Bogle on that point.

However, after spending about half of his “article” directly quoting Bogle, Kiyosaki mentions that he dislikes index funds because “[m]ost index funds think a 10 percent to 25 percent return is a good rate.” Kiyosaki also writes “[a]ctive investors can regularly beat those gains, especially if they stay away from traditional investments such as savings, stocks, bonds, and index and mutual funds.”

I don’t know what Kiyosaki is talking about, because as far as I know, there are only a handful of top money managers capable of providing consistent returns greater than 10-25% annually, and Kiyosaki is not one of them. The vast majority of investors (including yours truly) would be very happy to own a portfolio of mutual funds returning 10-25% per year.

Kiyosaki has a tendency to trump certain investing styles after they have already come into fashion and then mention that he has been investing in them and recommending them for years without any corresponding documentation. It is always the same with this guy – he’s a salesman, and based on his book sales he’s a good salesman at that, but he’s not the big-time investor he attempts to make himself out to be.

Although he has previously stated that the “rich dad” discussed in his books is a real person with was his financial mentor when growing up, he has never providing that individual’s name, and nobody has ever been able to find even a scintilla of evidence that this alleged “rich dad” even exists outside of Kioysaki’s mind.

Also, I know that he’s been trumpeting precious metals and energy stocks lately, but was he really buying them en mass in 2002 when money managers shunned them and they sat at historically low valuations? I certainly doubt it.

His column and books may be entertaining but take everything he writes with a grain of salt, as 90% of the personal stories in them are almost certainly fabricated, as discussed on this website.

He basically attempts to argue that mutual funds are wastes of money because of the fees they charge. He borrows quite a bit from an interview given by Vanguard founder John Bogle in which Bogle mentioned that mutual funds charging high fees are doing a disservice to most investors because the investors take 100% of the risk, put up 100% of the amount to be invested, but over time make quite a bit of money for the companies offering the mutual funds.

That’s fine and I do not disagree with that allegation. Bogle thinks that actively managed funs generally charge too much and that most investors would instead be better served investing in index-tracking funds. I also agree with Bogle on that point.

However, after spending about half of his “article” directly quoting Bogle, Kiyosaki mentions that he dislikes index funds because “[m]ost index funds think a 10 percent to 25 percent return is a good rate.” Kiyosaki also writes “[a]ctive investors can regularly beat those gains, especially if they stay away from traditional investments such as savings, stocks, bonds, and index and mutual funds.”

I don’t know what Kiyosaki is talking about, because as far as I know, there are only a handful of top money managers capable of providing consistent returns greater than 10-25% annually, and Kiyosaki is not one of them. The vast majority of investors (including yours truly) would be very happy to own a portfolio of mutual funds returning 10-25% per year.

Kiyosaki has a tendency to trump certain investing styles after they have already come into fashion and then mention that he has been investing in them and recommending them for years without any corresponding documentation. It is always the same with this guy – he’s a salesman, and based on his book sales he’s a good salesman at that, but he’s not the big-time investor he attempts to make himself out to be.

Although he has previously stated that the “rich dad” discussed in his books is a real person with was his financial mentor when growing up, he has never providing that individual’s name, and nobody has ever been able to find even a scintilla of evidence that this alleged “rich dad” even exists outside of Kioysaki’s mind.

Also, I know that he’s been trumpeting precious metals and energy stocks lately, but was he really buying them en mass in 2002 when money managers shunned them and they sat at historically low valuations? I certainly doubt it.

His column and books may be entertaining but take everything he writes with a grain of salt, as 90% of the personal stories in them are almost certainly fabricated, as discussed on this website.

The Nasdaq 100 ETF (QQQQ) Is Paying A Quarterly Dividend On July 31, 2006

The Nasdaq 100 ETF (symbol: QQQQ) is paying a dividend of $0.0257 per share on July 31, 2006. This dividend is being paid to shareholders of record as of June 20, 2006.

As with QQQQ's previous distribution in April 2006, it took me awhile to find the actual distribution date of this dividend. Yahoo Finance had indicated that the dividend was declared on June 16, 2006, but it did not list when the payout date would be. I was finally able to determine the payout date after some searching on Google and finding this article.

As with QQQQ's previous distribution in April 2006, it took me awhile to find the actual distribution date of this dividend. Yahoo Finance had indicated that the dividend was declared on June 16, 2006, but it did not list when the payout date would be. I was finally able to determine the payout date after some searching on Google and finding this article.

Friday, June 16, 2006

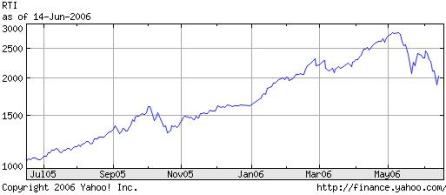

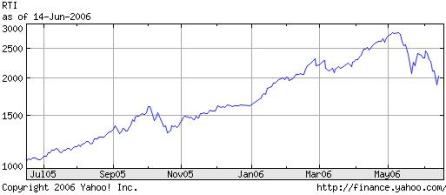

The Volatility of the Russian Stock Market

The Russian stock market has taken it on the chin over the past six weeks or so. For example, the Russia RTX stock index (see the chart below) has fallen from an intra-day high of 2955 on May 10 to a close of 2105 as of today. That is a drop of 28.7%!

However, the index is still up substantially over the past 52 weeks. It closed at 1057 on June 16, 2005. That is a gain of 1048 points, or 99%. It amazes me that the stock market index for country as big as Russia can be this volatile.

I personally will continue to invest in Russia stocks via the Templeton Russia and Eastern European fund (symbol: TRF). However, I will continue to limit TRF to no more than about 3% of my long-term portfolio.

However, the index is still up substantially over the past 52 weeks. It closed at 1057 on June 16, 2005. That is a gain of 1048 points, or 99%. It amazes me that the stock market index for country as big as Russia can be this volatile.

I personally will continue to invest in Russia stocks via the Templeton Russia and Eastern European fund (symbol: TRF). However, I will continue to limit TRF to no more than about 3% of my long-term portfolio.

Monday, June 05, 2006

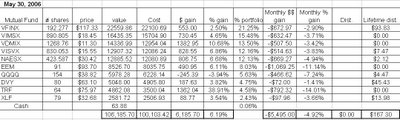

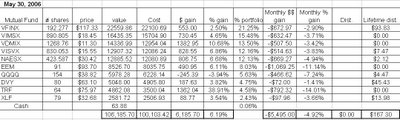

May Returns For My Model Long-Term Portfolio

My Hypothetical Model Portfolio performed very poorly in May. As of the market close on May 30, 2006, the Hypothetical Model Portfolio* dropped $5,495, or 4.92% during May. However, the Hypothetical Model Portfolio is still up $6185.70 in 2006, a gain of 6.19%, as shown on the table below (click for a larger image of the table).

Every one of the holdings went down, as May was a horrible month for stock market investors across the board. Foreign holdings were my worst performers in April, with the Templeton Russia closed-end fund (TRF) plummeting 14.01% and the Emerging Markets ETF (EEM) dropping 11.14%. Despite these huge drops, TRF and EEM are still up 38.91% and 6.11%, respectively, in 2006. My two best performers were the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) and Vanguard S&P 500 index fund (VFINX) which dropped 1.41% and 2.90%, respectively.

I suspect that the ugly May results do not represent anything other than a correction. The U.S. economy is still humming along and the FED will probably stop raising rates sometime soon. The Hypothetical Model Portfolio is still on pace for a solid 15.5% total return in 2006 even after the May correction.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

Every one of the holdings went down, as May was a horrible month for stock market investors across the board. Foreign holdings were my worst performers in April, with the Templeton Russia closed-end fund (TRF) plummeting 14.01% and the Emerging Markets ETF (EEM) dropping 11.14%. Despite these huge drops, TRF and EEM are still up 38.91% and 6.11%, respectively, in 2006. My two best performers were the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) and Vanguard S&P 500 index fund (VFINX) which dropped 1.41% and 2.90%, respectively.

I suspect that the ugly May results do not represent anything other than a correction. The U.S. economy is still humming along and the FED will probably stop raising rates sometime soon. The Hypothetical Model Portfolio is still on pace for a solid 15.5% total return in 2006 even after the May correction.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

Subscribe to:

Posts (Atom)