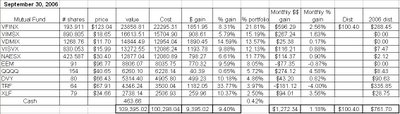

The portfolio was strong throughout the month. Tech stocks led the way for the second straight moneth, with the Nasdaq 100 ETF (QQQQ) rising 4.58%. The second biggest winner (on a percentage basis) was the S&P 500 Financial components ETF (XLF), which appreciated by 3.56%. Large cap stocks also performed very well - the Vanguard S&P 500 Index fund (VFINX) rose about 2.56%.

Small caps and international stocks were laggards during September, possibly due to a stronger U.S. dollar. The Templeton Russia closed-end fund (TRF) and

the iShares Emerging Markets ETF (EEM) both posted negative returns, falling about 4.00% and 0.87%, respectively. Other dogs include the Vanguard Developed Markets Index fund (VDMIX), the Vanguard Small Cap Value Index (VISVX), and the Vanguard Small Cap Index (NAESX) which rose just 0.17%, 0.88%, and 0.90%, respectively.

One of the holdings in my Hypothetical Model Portfolio, VFINX, paid dividends during Septmember. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. VFINX paid a dividend of $0.52/share (a total of $100.40) which was reinvested on September 22 to purchase an additional 0.829 shares at a price of $121.08/share.

I was glad to see decent returns in August. Hopefully stocks will perform well during the 4th quarter of 2006 so that my Hypothetical Model Portfolio will end 2006 up 10-15%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

No comments:

Post a Comment