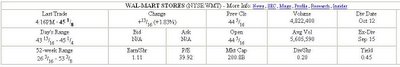

Take a guess as to the date of this fundamental data. Give up? It's from September 1999! Now take a look at this stock quote and fundamental data for WMT from today, January 23, 2006:

As one can clearly see, WMT is trading for less today than it was nearly 6 1/2 years ago. In case you are wondering, WMT has not split during the past 6 1/2 years. Instead, its valuation relative to its earnings has shrunk substantially as its stock price has basically moved sideways while its earnings have continued to increase at around 15% per year.

Its EPS has risen from about $1.11 per share to about $2.57 per share, decreasing its trailing P/E ratio from close to 40 all the way down to about 17.4 today. Its dividends per share have risen about 18% annually, tripling from 20 cents per share (yield of about 0.45%) to 60 cents per share (yield of about 1.34%). Meanwhile, WMT has been aggressviely buying back shares, decreasing the number of shares outstanding from about 4.46 billion to 4.16 billion.

I personally believe that WMT is long-term "BUY" right now. As one can see in this Value Line report, WMT's trailing P/E ratio is the lowest it has been since at least 1988, and its dividend yield is the highest it has been since at least 1988 (and possibly even earlier - I don't have all of the historical data at my disposal). It's not often that one has the opportunity to purchase shares of a top-notch growing company like Wal-Mart at an historically cheap valuation like this.

I don't mean to imply or suggest that WMT is definitely going to outperform over the next six month or even one year. However, over the long haul it should perform better than the stock market as a whole due to its current attractive valuation and relatively rapidly growing earnings.

No comments:

Post a Comment