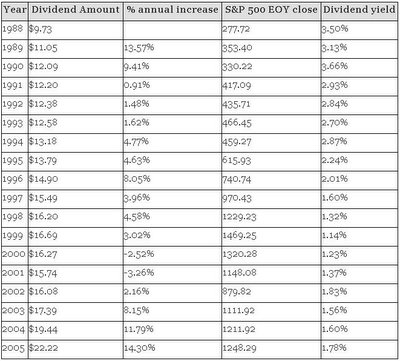

As shown below, the annual % increase of dividends has been increasing very rapidly since 2002. That is undoubtedly due to the strong corporate profits and the dividend tax decrease that Congress passed in 2003. According to Standard & Poor's, the dividends are projected to increase to $24.50 for 2006, a 10.26% increase over 2005.

I anticipate large % increases in the dividend rate in the coming years. With the favorable tax treatment and Baby Boomers nearing retirement age, the Boomers are going to want extra dividend income and will pressure companies to keep raising dividends. This is definitely a plus for investors. The great thing about dividends is that they provide investors with a return without forcing the investors to sell at inopportune moments to realize these returns.

***An updated version of this chart containing data from 1977-2014 may be found in this post.

No comments:

Post a Comment