The portfolio was down substantially (bottoming near a loss of about $6,000) through most of the first half of June before recovering strongly near the end of the month to finish flat.

The Templeton Russia closed-end fund (TRF) continued to struggle, finishing with a loss of 1.53% for the month after being down about 30% for the month as of June 13th. The second-worst performer was the SPDR Financial components (XLF) which fell 1.22%.

On a positive note, my small cap holdings performed well. The Vanguard Small Cap Value Index (VISVX) was my top performer, returning 1.09% in June. The Vanguard Small Cap Index mutual fund (NAESX) was also positive, returning 0.20%. The Emerging Markets ETF (EEM) was another positive performer, recovering from a disastrous May by returning a respectable a respectable 0.21% in June. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) also performed well, returning 0.83% during June.

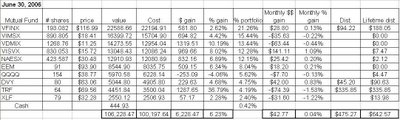

Four of the holdings in my Hypothetical Model Portfolio paid dividends in June. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The reason I am doing this is because the index mutual funds in this portfolio do not charge a transaction fee for reinvesting dividends. To reinvent dividends for any of the ETFs or TRF, on the other hand, would cause me to incur transaction fees for the trading commissions.

The Vanguard S&P 500 index fund (VFINX) paid a dividend of $0.49/share (a total of $94.22) which was reinvested on June 23 to purchase an additional 0.805 shares at a price of $116.99/share. DVY paid a dividend of $0.56501 on June 28 (a total of $45.20) which was moved to "CASH" on the table shown below. TRF paid a long-term distribution of $5.2476/share on June 19 (a total of $335.85) that was also moved to "CASH" on the table below.

The economy continues to hum along despite the FED interest rate increases. I suspect that the FED will raise rates a couple more times and then be done with it. Hopefully the market will finally surge at that time.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

2 comments:

Very interesting and articulated points. Just curious - why don't you reinvest the dividends from the ETFs in your model portfolio?

The reason why I don't invest the dividends from the ETFs in the model portfolio is because the dividend amounts are too small relative to the cost of a trade to make it worthwhile. Even at $5 per trade, it's just not worth paying $5 to reinvest a dividend amount of $100. In real life, I couldn't justify paying 5% of my investment in transaction costs.

It's a different story with the index funds because I don't pay a load or any transaction fees when reinvesting dividends or other distributions.

Post a Comment