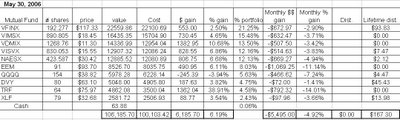

Every one of the holdings went down, as May was a horrible month for stock market investors across the board. Foreign holdings were my worst performers in April, with the Templeton Russia closed-end fund (TRF) plummeting 14.01% and the Emerging Markets ETF (EEM) dropping 11.14%. Despite these huge drops, TRF and EEM are still up 38.91% and 6.11%, respectively, in 2006. My two best performers were the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) and Vanguard S&P 500 index fund (VFINX) which dropped 1.41% and 2.90%, respectively.

I suspect that the ugly May results do not represent anything other than a correction. The U.S. economy is still humming along and the FED will probably stop raising rates sometime soon. The Hypothetical Model Portfolio is still on pace for a solid 15.5% total return in 2006 even after the May correction.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

No comments:

Post a Comment