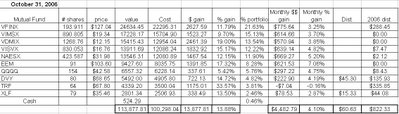

The iShares Emerging Markets ETF (EEM) led the portfolio higher, returning 7.06% for the month. Small caps and tech stocks were also strong performers. The Vanguard Small Cap Index (NAESX), Vanguard Small Cap Value Index (VISVX), and Nasdaq 100 ETF (QQQQ) rose 5.20%, 4,82%, and 4.75%, respectively.

The only laggards during October were the S&P 500 Financial components ETF (XLF) and the Templeton Russia closed-end fund (TRF) , returning 2.87% and losing 0.16%, respectively.

Two of my holdings paid dividends during October. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) paid a dividend of $0.5662 (a total of $45.30 ), and XLF paid a dividend of $0.194/share (a total of $15.33).

Stocks look good heading toward the end of 2006. With a strong finish during November and December, my Hypothetical Model Portfolio could close the year up 15-20%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

September 2006 Returns

No comments:

Post a Comment