Home Depot (symbol: HD) announced today that it is raising its dividend by 50% to 22.5 cents per quarter, beginning with the dividend being paid on November 30, 2006. This is the second time Home Depot has raised its dividend during 2006. Back in Jaunary 2006, Home Depot announced it was raising its dividend from 10 cents per quarter to 15 cents per quarter. So that is a total increase of 125% in Home Depot's quarterly dividend this year! Back in 1999 Home Depot paid 2.75 cents/quarter. Its dividends have therefore increased some 718% since 1999. The odd thing is that Home Depot is still trading below where it was in 1999 despite the huge increase in its dividend and a more than 200% increase in its earnings per share.

I wrote a post back in February where I argued that Home Depot is a "strong buy." I still believe that Home Depot is a good-long term buy. It may not perform well over the short term, but as its earnings and dividends continue to rise Wall Street will eventually take notice and bid its shares higher like it did during the 90s. The Value Line projects that Home Depot will trade between $95 and $125/share between 2009-2011, a gain of between about 160% and 245%.

Thursday, November 16, 2006

Sunday, November 12, 2006

Best Posts Over The Past Year

I started my Finance and Investments blog on November 8, 2005. I have posted 77 times since then, discussing a number of topics primarily focusing on stock market investing (including tracking a model portfolio), basic coin collecting, and general personal finance issues. Here are some of my favorite posts from the past year:

Best posts relating to Stock Market Investing:

(1) Selling stocks short

(2) Historical Dividends for the S&P 500

(3) The "FED Model" theory of equity valuation

(4) The MSCI EAFE index is the "S&P 500" of foreign stocks

(5) Small Cap Value stocks outperform Large Cap Growth stocks

(6) "Periodic Table" of Equity Style Investment Returns for 1986-2005

(7) Investing In Growth Stocks Is Not For The Faint Of Heart

(8) Criticisms of Dollar-Cost Averaging Investment Strategies Are Unjustified

(9) Stock Market Styles Are Very Cyclical

(10) Think Twice Before Investing In Companies That Manufacture Memory Devices Or Other Electronic "Commodities"

(11) The Templeton Russia & East European Fund

(12) Closed-end funds are the best way for the common man to invest in Russia and India

(13) Wal-Mart's Stock Valuation Looks Compelling

Best posts relating to Coin Collecting:

(1) Save Your Pre-1982 Pennies

(2) With Commodities Are Soaring, I am Saving Nickels and Pre-1982 Pennies

(3) I'm Still Saving U.S. Nickel Coins

Best posts relating to Miscellaneous Personal Finance Issues:

(1) "Revolt of the Fairly Rich"

(2) Robert Kiyosaki Has Written Another Flimsy Article For Yahoo Finance

(3) Everbank Provides An Easy Way To Speculate In Foreign Currency And Precious Metals

Best posts relating to Stock Market Investing:

(1) Selling stocks short

(2) Historical Dividends for the S&P 500

(3) The "FED Model" theory of equity valuation

(4) The MSCI EAFE index is the "S&P 500" of foreign stocks

(5) Small Cap Value stocks outperform Large Cap Growth stocks

(6) "Periodic Table" of Equity Style Investment Returns for 1986-2005

(7) Investing In Growth Stocks Is Not For The Faint Of Heart

(8) Criticisms of Dollar-Cost Averaging Investment Strategies Are Unjustified

(9) Stock Market Styles Are Very Cyclical

(10) Think Twice Before Investing In Companies That Manufacture Memory Devices Or Other Electronic "Commodities"

(11) The Templeton Russia & East European Fund

(12) Closed-end funds are the best way for the common man to invest in Russia and India

(13) Wal-Mart's Stock Valuation Looks Compelling

Best posts relating to Coin Collecting:

(1) Save Your Pre-1982 Pennies

(2) With Commodities Are Soaring, I am Saving Nickels and Pre-1982 Pennies

(3) I'm Still Saving U.S. Nickel Coins

Best posts relating to Miscellaneous Personal Finance Issues:

(1) "Revolt of the Fairly Rich"

(2) Robert Kiyosaki Has Written Another Flimsy Article For Yahoo Finance

(3) Everbank Provides An Easy Way To Speculate In Foreign Currency And Precious Metals

Wednesday, November 08, 2006

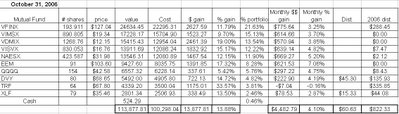

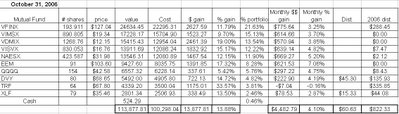

October 2006 Returns For My Model Long-Term Portfolio

October was a great month from my Hypothetical Model Portfolio. As of the market close on October 31, 2006, the Hypothetical Model Portfolio* increased in value by $4482.79, or about 4.10% during the month of October. The Hypothetical Model Portfolio is now up $13,877.81 in 2006, a gain of 13.88%, as shown on the table below (click for a larger image of the table).

The iShares Emerging Markets ETF (EEM) led the portfolio higher, returning 7.06% for the month. Small caps and tech stocks were also strong performers. The Vanguard Small Cap Index (NAESX), Vanguard Small Cap Value Index (VISVX), and Nasdaq 100 ETF (QQQQ) rose 5.20%, 4,82%, and 4.75%, respectively.

The only laggards during October were the S&P 500 Financial components ETF (XLF) and the Templeton Russia closed-end fund (TRF) , returning 2.87% and losing 0.16%, respectively.

Two of my holdings paid dividends during October. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) paid a dividend of $0.5662 (a total of $45.30 ), and XLF paid a dividend of $0.194/share (a total of $15.33).

Stocks look good heading toward the end of 2006. With a strong finish during November and December, my Hypothetical Model Portfolio could close the year up 15-20%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

September 2006 Returns

The iShares Emerging Markets ETF (EEM) led the portfolio higher, returning 7.06% for the month. Small caps and tech stocks were also strong performers. The Vanguard Small Cap Index (NAESX), Vanguard Small Cap Value Index (VISVX), and Nasdaq 100 ETF (QQQQ) rose 5.20%, 4,82%, and 4.75%, respectively.

The only laggards during October were the S&P 500 Financial components ETF (XLF) and the Templeton Russia closed-end fund (TRF) , returning 2.87% and losing 0.16%, respectively.

Two of my holdings paid dividends during October. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) paid a dividend of $0.5662 (a total of $45.30 ), and XLF paid a dividend of $0.194/share (a total of $15.33).

Stocks look good heading toward the end of 2006. With a strong finish during November and December, my Hypothetical Model Portfolio could close the year up 15-20%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

September 2006 Returns

Thursday, November 02, 2006

Fidelity's Magellan Fund Is Being Routed By Its Benchmark Index

Fidelity's Magellan mutual fund was once that most admired mutual fund in the industry from the mid-1970s until the early 1990s. The legendary fund manager Peter Lynch steered the fund to whopping 29% annual returns during his years at the helm between 1977 and 1990. A $10,000 investment in Magellan in 1977 would have grown to $288,000 by 1990, as discussed in this article.

Unfortunately, Magellan's performance has lagged for the past 10+ years due to bad investments by its managers. Its huge size has also been a hindrance, as enormous growth-oriented mutual funds have difficulty closing positions in growth stocks without adversely affecting the price of stocks it is selling.

According to this recent article in Fortune magazine, Magellan is currently mired in its second-worst performance slump relative to the S&P 500 index in 30 years.

Unfortunately, Magellan's performance has lagged for the past 10+ years due to bad investments by its managers. Its huge size has also been a hindrance, as enormous growth-oriented mutual funds have difficulty closing positions in growth stocks without adversely affecting the price of stocks it is selling.

According to this recent article in Fortune magazine, Magellan is currently mired in its second-worst performance slump relative to the S&P 500 index in 30 years.

Subscribe to:

Posts (Atom)