Midcap stocks are generally defined as those of companies with market capitalizations

between $1 billion and $10 billion. The S&P 400 Midcap Index is the most widely-followed of all U.S. Midcap stock market indices.

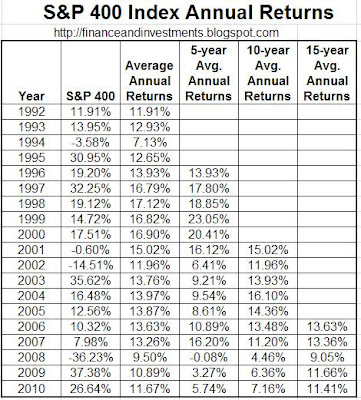

The S&P 400 Midcap Index was introduced in June 1991 by Standard & Poors to track the performance of U.S. mid cap stocks. I have previously posted charts with annual returns through

2007, 2008, and

2009. The chart below has been updated to include returns from 1992-2010.

As shown, the S&P 400 Midcap Index provided another strong year in 2010, returning 26.64%. The cumulative return during calendar years 2009 and 2010 was an impressive 73.98%. The gains during 2009 and 2010 more than make up for the 36.23% drop in 2008. The annualized returns of the Index from 1992-2010 was 11.67% and the 5-year annualized returns through 2010 were 5.74%. The total returns (including reinvested dividends) between January 1, 1992 and December 31, 2010 was an impressive 713.95%.

The chart below also shows five-year annualized returns, starting with the fifth full calendar year of the existence of the S&P 400 Midcap Index (i.e., 1996) and ten-year annualized returns, starting with the tenth full calendar year of the existence of the Index. As shown, the highest annualized five-year return was 23.05% (between 1995 and 1999) and the lowest was -0.08% (between 2004 and 2008). The highest annualized return was 16.10% (between 1995 and 2004) and the lowest was 4.46% (between 1999 and 2008).

As I have mentioned in previous years, I am a big fan of midcap stocks and recommend that any long-term investor seriously consider investing money in midcap stocks, such as those tracking the S&P 400 Midcap Index (e.g., the Midcap SPDR ETF (symbol:

MDY) tracks the S&P 400 Midcap Index). Midcaps tend to provide higher returns over time than large cap stocks, such as those comprising the S&P 500 Index, although such stocks are generally more volatile over shorter time periods.

**

I have posted an updated chart for the period between 1992-2022.

I have posted an updated chart for the returns of the S&P 500 Index during the period between 1926-2015.

I have posted an updated chart for the returns of the S&P 500 Index during the period between 1926-2015.