The portfolio was down substantially earlier in July before recovering strongly near the end of the month. This choppy performance is similar to what happened during June 2006. Tech stocks continued to struggle during July, resulting in a drop of 4.24% in the Nasdaq 100 ETF (QQQQ). The second biggest losss (on a percentage basis) was the Vanguard Small Cap Index (NAESX) which dropped 3.31% during July. The other big losers were the Vanguard Midcap Index (VIMSX) which fell 2.28% and the Templeton Russia closed-end fund (TRF) which dropped 2.24%.

On a positive note, large caps and dividend paying stocks performed well in July. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) and the S&P 500 Financial components ETF (XLF) returned 3.31% and 3.06%, respectively. Other top performers include the Emerging Markets ETF (EEM) and the Vanguard Developed Markets Index (VDMIX), which returned 2.34% and 1.16%, respectively.

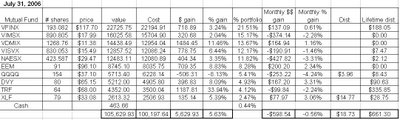

Two of the holdings in my Hypothetical Model Portfolio paid dividends in July. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below.

XLF paid a dividend of $0.187 on July 31 (a total of $14.77) which was moved to "CASH" on the table shown below. QQQQ paid a dividend of $0.0257/share on July 31 (a total of $3.96) that was also moved to "CASH" on the table below. Accordingly, the value of accumulated and uninvested distributions is now up to $463.66.

The Hypothetical Model Portfolio's performance was not bad during July. The main thing holding it back was the poor return of tech stocks which dragged down QQQQ. Tech stocks have been out of favor with investors for 6+ years after so many got burned holding them when the bubble burst in 2000. Eventually investors will warm to tech again. I don't know when that will happen, but rest assured that it will eventually happen. That is why I included QQQQ in my Hypothetical Model Portfolio. I still firmly believe that this portfolio will outperform the major stock market averages over time.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

3 comments:

Jim,

I want to complement you on the wonderful blog and great investment thinking.

I recent created a post discussing diversified index portfolios and available options for constructing them (Wisdom Tree and DFA). Can you check it out? I don't have your e-mail so this is the only way I can get it to you (and ask your thoughts). Here's the article.

Also, can we exchange links? I'd be grateful and honored.

Have a wonderful day,

makingourway

www.makingourwayblog.com

Makingourway, we can defintely exchange links. I added your link to my blog.

Jim,

I'll add you to my blog, but didn't see mine listed in your links section - could it be a problem on my side?

regards,

makingourway

www.makingourwayblog.com

Post a Comment