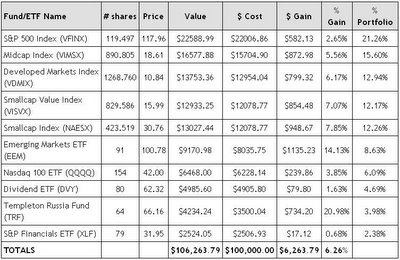

Small and mid-cap stocks outpeformed their larger counterparts, such as those in the S&P 500. However, the real stars from January 2006 were foreign stocks. Emerging markets did particularly well with EEM returning over 14% and TRF advancing close to 21%.

I think that the market is probably due for a little bit of a pullback, but I do think that 2006 will be a better year for stocks than 2005. With the prices of commodities still increasing, I expect TRF and EEM to continue to outperform this year because both of these equities hold the stocks of many companies that export commodities such as oil.

No comments:

Post a Comment