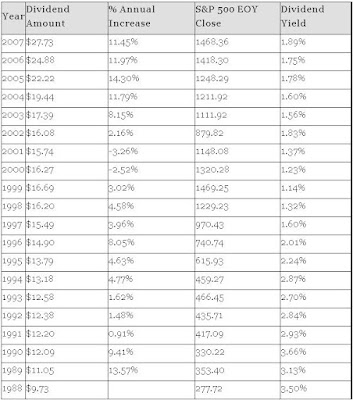

The chart shown below (click on the chart to see a larger image) illustrates dividend information for the S&P 500 from 1988-2007. As shown, the dividends paid by the S&P 500 component companies increased from $9.73 in 1988 to $27.73 in 2007. That works out to a total increase of 184.99% and an average annual increase of 5.667% in the dividend yield. This is an impressive annual increase considering that this time period includes the terrible bear market from 2000 to 2002 when the S&P 500 lost about 50% of its value.

As shown in the chart below, the annual % increase of dividends has been increasing very rapidly since 2002. This rapid increase has been fueled both by strong corporate profits over the past few years and the dividend tax cut that Congress passed in 2003. According to Standard & Poor's, the dividends are projected to increase to $30.30 for 2008, a 9.268% increase over 2007, although the 2008 estimate might be not be attainable given the weakening U.S. economic conditions.

I anticipate further % increases in the dividend rate in the coming years. As I mentioned in my 2006 post on S&P 500 dividends, companies are going to continue to be pressured to continue raising dividends due to the combination of favorable tax treatment and the fact that Baby Boomers are nearing retirement age and are going to want extra dividend income and will pressure companies to keep raising dividends. However, if a Democrat wins the November 2008 U.S. Presidential election, I expect the favorable tax treatment of dividends to end and dividend tax rates to rise substantially. Accordingly, the era of rapid % dividend increases may be coming to an end.

***An updated version of this chart containing data from 1977-2016 may be found in this post.

***An updated version of this chart containing data from 1977-2016 may be found in this post.

2 comments:

Lol. You expect further dividend increases and you expect them to end ... good call!

But seriously, got here via googling your '05 small cap value post. Any thoughts on the small caps here and now?

We're probably in a recession right now, so dividends might plateau this year, or only rise by a small amount.

I do anticipate further dividend increases going forward as I think that investors realize the importance of steady dividend income.

I never wrote that I expected dividend increases to end anytime soon. However, if the favorable tax treatment is removed, we may see more companies returning excess cash to shareholders via share buybacks, as opposed to massive dividend increases.

I'm not sure how small caps are going to perform over the next year or so, but I definitely like them as part of my overall long term portfolio. I still allocate about 24% of my overall portfolio to small cap stocks (about half in diversified small cap and half in small cap value), as discussed here:

http://financeandinvestments.blogspot.com/2006/01/my-model-long-term-portfolio.html

Post a Comment