Standard & Poor's introduced its first stock market index in 1923 and created the S&P 500 Index in 1957. Prior to 1957, Standard & Poor's utilized a different index, the S&P 90 Index, that tracked performance of large company stocks. Accordingly, market returns for the S&P 500 Index and it predecessor index are available going back to the 1920s. I have been able to locate a website with such returns dating back to 1926, as shown in the charts below (click on either chart for a larger view).

The YTD total return (including dividends) for the S&P 500 Index is approximately -39.4%. If the S&P 500 Index were to end the year at the same level as it closed on Friday, November 14, 2008, this would constitute the second worst annual return for the S&P 500 Index (or its predecessor index) in the 83 years for which I have data. The only year with a worse performance was 1934, during the midst of the Great Depression, when the index dropped about 43.34%!

The U.S. economy is almost certainly in a recession and it could last several additional quarters, and possibly through the end of 2009. However, the onslaught of another "Great Depression" is hard to imagine, so this might be a good time to consider investing more money back in the market at the current depressed levels.

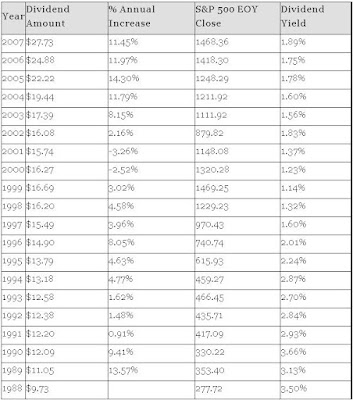

The charts below list calendar year returns, annualized returns through the end of each calendar year, and annualized returns for 5-, 10-, 15-, 20-, and 25-year periods. As shown, as of today, the annualized return of the S&P 500 Index (and its predecessor index) is about 9.26%, the 5-year annualized return is about -2.92%, the 10-year annualized return is about -1.75%, and 15-year annualized return is about 6.19%, the 20-year annualized return is about 8.22%, and the 25-year annualized return is about 9.61%.

The current 5-year annualized return of -2.92% is the worst it has been since 1941, during World War II, when the annualized 5-year return was about -7.51%. The current 10-year annualized return of about -1.75% is the worst it has ever been based on the data I have back through 1926!

The S&P 500 Index is at extremely low valuations relative to where it has been in recent years. I have a strong feeling that sometime in the future investors are going to look back at the 2008 market and realize that stocks were a screaming "buy." My assessment does not mean that I expect stocks to pop up 40% in a short period of time from where they are now. Instead, it wouldn't surprise me to see the S&P 500 Index drop another 10% from where it is now, as there is quite a bit of fear in the markets at this time and investors have lost confidence in the markets. However, as some point the S&P Index and other U.S. stocks will be much, much higher than they are today, as legendary investor Warren Buffet argued last month.

I have posted an updated chart for the returns of the S&P 500 Index during the period between 1926-2015.