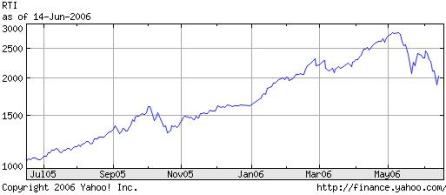

However, the index is still up substantially over the past 52 weeks. It closed at 1057 on June 16, 2005. That is a gain of 1048 points, or 99%. It amazes me that the stock market index for country as big as Russia can be this volatile.

I personally will continue to invest in Russia stocks via the Templeton Russia and Eastern European fund (symbol: TRF). However, I will continue to limit TRF to no more than about 3% of my long-term portfolio.

3 comments:

Hi Jim, I've been invested in TRF for little over a year and a half. When I first bought it, it was kind enough to drop 30% in two months. But I stuck my head in the ground and continued to hold it, after awhile it rebounded, and surged in a matter of days last fall. I have continued to buy more of it, and TRF is now 10% of my portfolio. Along with the very nice dividends that the fund gives me, it is my best performer. This is one of those funds you really shouldn't look at more than 4 times a year, or you'll want to kill yourself.

I think that Russia is one of the best emerging markets in which to invest. They have an excellent education system and a good infrastructure.

I remmeber looking at TRF back in 1995 when it was first introduced because I had read an article about the manager, Mobius, in Kiplinger's or Money magazine. It's amazing how well TRF has performed considering that the Russia currency collapsed in 1997-98.

nyc, i agree with you whole heartedly!

I've been thinking about getting in on it (limiting it to 3% as jim recommmends), but am concerned it might still be too high.

Good point about hte currency, too.

Any thoughts anyone?

regards,

makingourway

Post a Comment