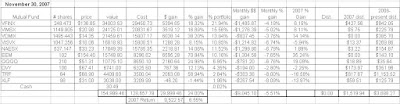

As of the market close on November 30, 2007, the Hypothetical Model Portfolio was down $9045, or about 5.51% during November. However, the Hypothetical Model Portfolio is still up about $9522 in 2007, a gain of 6.556%, as shown on the table below (click for a larger image of the table). The 2007 returns for the Hypothetical Model Portfolio are currently slightly ahead of the 6.15% return of the Vanguard S&P 500 Index fund (VFINX), my benchmark proxy for the S&P 500 index.

All of the holdings were down in November, with financials and emerging markets leading the charge downward. The SPDR Financial components ETF (XLF) dropped 8.09%, likely due to that large position it holding in Citigroup, a company that performed very poorly during the month as it announced huge losses and the exit of its chairman and CEO. Emerging markets dropped due the overall stock market turbulence, as the riskiest equities tend to plummet the most during times of uncertainty. The Templeton Russia closed-end fund (TRF) dropped 8.0% and the iShares Emerging Markets ETF (EEM) dropped 7.65%. Tech stocks also struggled, with the Nasdaq 100 ETF (QQQQ) dropping 6.76%.

Small caps and midcaps struggled during the month. The Vanguard Small Cap Index mutual fund (NAESX) dropped 6.79% and the Vanguard Small Cap Value Index fund (VISVX) fell 6.74%. The Vanguard Midcap Index mutual fund (VIMSX) was the only other holding to fall more than 5% during the month.

The results of the portfolio holdings for the first 11 months of 2007 have varied substantially, with six holdings showing gains and four showing losses. The biggest gainer so far is EEM, which is up about 35.24% for the year. The biggest loser is TRF, which has fallen about 16.58%, primarily due to premium compression, as I have previously discussed.

I anticipate that the portfolio returns will continue to be volatile in December and expect the portfolio to close out 2007 with a small gain of 5-10% for the year. It would not surprise me if the U.S. economy slips into recession in early 2008. If a recession does occur, I expect it to be a very mild recession. Global growth is strong and should help support the U.S. economy even in the face of recessionary winds.

*The Hypothetical Model Portfolio was created with an investment of $100,000 in securities as of the closing values on December 30, 2005 and an additional $25,000 was invested n securities as of the closing values on December 29, 2006. The reason why the total cost in the chart is greater than $125,000 is because the total cost accounts for the value of distributions reinvested into the mutual funds in the portfolio.

*The Hypothetical Model Portfolio was created with an investment of $100,000 in securities as of the closing values on December 30, 2005 and an additional $25,000 was invested n securities as of the closing values on December 29, 2006. The reason why the total cost in the chart is greater than $125,000 is because the total cost accounts for the value of distributions reinvested into the mutual funds in the portfolio.October 2007 Returns

No comments:

Post a Comment