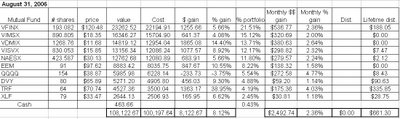

The portfolio rallied toward the end of the month to show the impressive August returns. Tech stocks led the way, with the Nasdaq 100 ETF (QQQQ) rising 4.77%. The second biggest winner (on a percentage basis) was the Templeton Russia closed-end fund (TRF), which increased in value by about 4.03%, bringing its total return for 2006 through August 31st to an impressive 38.95%. Other solid performers included the Vanguard Developed Markets Index fund (VDMIX) and the Vanguard S&P 500 Index fund (VFINX), which returned about 2.64% and 2.36%, respectively, during August.

Dividend-paying stocks and the emerging markets were the laggards last month. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY), the S&P 500 Financial components ETF (XLF), and the iShares Emerging Markets ETF (EEM) had sub-par returns of about 1.14%, 1.18%, and 1.58%, respectively. I suppose this was to be expected, as these three ETFs were the top performers in July.

I was glad to see QQQQ finally show some decent returns in August. It was bound to happen sooner or later. QQQQ is still down about 3.75% on the year, but I suspect we'll see tech stocks rally through the last quarter of 2006.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

1 comment:

Thanks. I got the idea to monitor a value portfolio that I analyzed and developed in Indian stocks in January 2003 based on Graham-Rao method of analysis.

I am presently studying Security Analysis by Graham and Dodd again and posting important ideas from that book on my blog.

Thanks once again for the idea of posting portfolio performance.

kvssnrao

Post a Comment