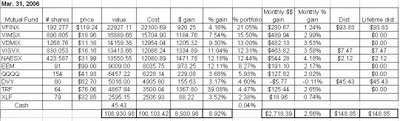

Foreign holdings were my top performers in April, with the Templeton Russia closed-end fund (TRF) leading the way with a strong 16.16% return. The Emerging Markets ETF (EEM) was the second-best performer with a 6.52% return, and the Vanguard Developed Markets index fund (VDMIX) came in third place with a return of 4.84%. Through the first four months of 2006, TRF is already up a whopping 61.55%, EEM is up 19.42%, and VDMIX is up 14.59%! I expect foreign equities to continue to perform well given that the U.S. Dollar is bound to fall relative to foreign currencies due to the United States’ massive trade deficit. Also, TRF and EEM are invested heavily in countries that are huge net exporters of oil and raw materials and will continue to benefit from the current commodities boom.

Other solid April performers include the SPDR Financial components (XLF) which returned 3.80% and the iShares Dow Jones U.S. Select Dividend Index ETF fund which returned 2.07%. Both of these invest heavily in financial stocks. These probably did well in April after the FED indicated it is close to halting its interest rate hikes.

Vanguard Index 500 mutual fund (VFINX) and the Vanguard Midcap Index mutual fund (VIMSX) were up just over 1% in April, and the small cap holdings (i.e., Vanguard Small Cap Index mutual fund (NAESX) and Vanguard Small Cap Value Index (VISVX)) were barely changed in April. The only holding that fell in value was the Nasdaq 100 ETF (QQQQ), which fell about .12%.

Two of the holdings in my Hypothetical Model Portfolio paid dividends in March. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or a closed end fund (i.e., TRF) are not reinvested- they will accumulate as "CASH" on the performance table below. The reason I am doing this is because the index mutual funds in this portfolio do not charge a transaction fee for reinvesting dividends. To reinvent dividends for any of the ETFs or TRF, on the other hand, would cause me to incur transaction fees for the trading commissions.

XLF paid a dividend of $0.177 on April 28 (a total of $13.98), and QQQQ paid a dividend of $0.029 on April 28 (a total of $4.47), both of which were moved to "CASH" on the table shown below.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.