I wrote a post in February 2006 in which I argued that the S&P 500 was undervalued. Since then, the S&P 500 has risen from about 1283 to 1422, a return of 10.83%, excluding dividends. This is a strong gain and I think that the S&P 500 has further to go. Relative to bonds, the S&P 500 still appears to be undervalued.

According to Standard & Poor's, the projected reported earnings through 12/31/07 for the sum of the components of the S&P 500 is about $89.10/share. As discussed above, the S&P 500 index currently trades at about 1422. Accordingly, the forward P/E ratio of the S&P 500 index is about 15.96* (1422/$89.10). This is slightly higher than the historical P/E ratio of around 14-15. However, bonds are still more richly valued than their historical averages. Other asset classes such as real estate and commodities are also richly valued right now and have been for several years. As I wrote last February, it seems inevitable that stocks will eventually catch up to the performance of these other asset classes.

Stocks have been weighed down over the past couple years in large part due to high energy prices and a FED that had been steadily raising short-term interest rates. However, consumer price inflation is still low and bonds are expensive relative to historical averages. The yield on the 10-yr US bond is currently about 4.88%. The earnings yield on the S&P 500 based on estimated 2007 earnings* is about 6.27% (i.e., the inverse of the 15.96 P/E ratio). The earnings yield on the S&P 500 is therefore about 1.45% higher than the 10-yr bond yield. This is still a large disparity and will probably shrink over the next few years as the S&P 500 outperforms the 10-yr bond.

2007 should continue to be a good year for the S&P 500. The S&P 500 probably won't increase in value every month, but even after accounting for a pullback or two this should be a good year nevertheless.

* I used estimated "as reported" earnings in calculating the 2007 estimated earnings. Many stock market analysts use estimated "operating earnings" in calculating forward P/E ratios. The "as reported" earnings account for miscellaneous supposedly non-recurring "one-time" charges and expenses deducted from operating earnings. The "as reported" earnings provide a more realistic estimate of earnings because such miscellaneous non-recurring "one-time" charges and expenses occur every single year. It seems disingenuous to not factor them into the calculation of the forward P/E ratio.

Saturday, January 27, 2007

Sunday, January 21, 2007

S&P 500 Dividends (Updated through January 2007)

In February 2006 I wrote a post about S&P 500 dividends. I've decided it is time to update the chart to include dividend information for the full 2006 year. The dividend information is available at the Standard & Poor's website.

The chart shown below (click on the chart to see a larger image) illustrates dividend information for the S&P 500 from 1988-2006. As shown, the dividends paid by the S&P 500 component companies increased from $9.73 in 1988 to $24.88 in 2005. That works out to a total increase of 155.7% and an average annual increase of 5.354% in the dividend yield. Considering that this time period includes the horrible bear market from 2000 to 2002 when the S&P 500 lost about 50% of its value, I would say that the annual increase is impressive.

As shown in the chart below, the annual % increase of dividends has been increasing very rapidly since 2002. That is due both to the strong corporate profits over the past few years and the dividend tax decrease that Congress passed in 2003. According to Standard & Poor's, the dividends are projected to increase to $27.35 for 2007, a 9.928% increase over 2006.

I still anticipate large % increases in the dividend rate in the coming years. As I mentioned in my 2006 post on S&P 500 dividends, companies are going to continue to be pressured to continue raising dividends due to the combination of favorable tax treatment and the fact that Baby Boomers are nearing retirement age and are going to want extra dividend income and will pressure companies to keep raising dividends. The great benefit of dividends is that they provide investors with a return without forcing the investors to sell at inopportune moments to realize these returns.

***An updated version of this chart containing data from 1977-2014 may be found in this post.

The chart shown below (click on the chart to see a larger image) illustrates dividend information for the S&P 500 from 1988-2006. As shown, the dividends paid by the S&P 500 component companies increased from $9.73 in 1988 to $24.88 in 2005. That works out to a total increase of 155.7% and an average annual increase of 5.354% in the dividend yield. Considering that this time period includes the horrible bear market from 2000 to 2002 when the S&P 500 lost about 50% of its value, I would say that the annual increase is impressive.

As shown in the chart below, the annual % increase of dividends has been increasing very rapidly since 2002. That is due both to the strong corporate profits over the past few years and the dividend tax decrease that Congress passed in 2003. According to Standard & Poor's, the dividends are projected to increase to $27.35 for 2007, a 9.928% increase over 2006.

I still anticipate large % increases in the dividend rate in the coming years. As I mentioned in my 2006 post on S&P 500 dividends, companies are going to continue to be pressured to continue raising dividends due to the combination of favorable tax treatment and the fact that Baby Boomers are nearing retirement age and are going to want extra dividend income and will pressure companies to keep raising dividends. The great benefit of dividends is that they provide investors with a return without forcing the investors to sell at inopportune moments to realize these returns.

***An updated version of this chart containing data from 1977-2014 may be found in this post.

Wednesday, January 17, 2007

1980 - 2006 Stock Market Returns for Various Indices

I often read articles written by stock market pundits who argue that now is the time for growth stocks to outperform value stocks. Value stocks have trounced growth stocks since 2000 and it's time for the growth to finally beat the value stocks again, or at least that is what we are told. It is true that investment styles are cyclical, but I really question whether an investor would be better off listening to the pundits and trying to time such market reversals of fortune.

While sleuthing around on the Internet I came across some old versions of the Callan Periodic Table of Investment Returns that I have posted previously. I entered all of the data I found from 1980-2006 into a spreadsheet for small cap indices (Russell 2000, Russell 2000 Value, and Russell 2000 Growth), large cap indices (S&P 500, S&P/Citi 500 Value*, and S&P/Citi 500 Growth*), a broad-based foreign stock index(Morgan Stanley Capital International Index for the developed stock markets of Europe, Australasia, and the Far East ("MSCI EAFE index")), and an index of bonds (Lehman Brothers Aggregate Bond Index ("LB Agg.")).

As shown in the chart below (click on the image for a larger view), the Russell 2000 Value index has outperformed all other investment styles over the time frame, returning 4522.32%, which is an average annual return of 15.26%. The Russell 2000 Growth Index was the worst performer, on the other hand, providing a total return of just 937.98% over the time period, or about 9.05% per year. The formidable return of the Russell 2000 Value index is not surprising, considering that Small Cap Value stocks have routinely outperformed other investment styles over long periods of time as I have previously discussed.

What is surprising is just how poor the returns were for the Small Cap Growth stocks in the Russell 2000 Growth index - for all of the risk involved, investors are not adequately compensated, seeing as how the LB Agg. Index returned 948.45% over the time period, an average annual return of about 9.09% with far less risk.

Another thing I found surprising is that the S&P 500 Index provided much larger returns that the overall Russell 2000 Index. Small cap stocks absolutely trounced large caps during the 1970s, so I guess this is to be expected.

An additional item of interest is the return of the MSCI EAFE Index versus the S&P 500. As shown, the MSCI EAFE Index returned 1849.57%, or an average annual return of 11.63% during the time period. The S&P 500 provided much larger returns - a total return of 2802.82%, or an average of 13.29% between 1980 and 2006. I expect that the MSCI EAFE Index will catch up to the S&P 500's performance in the future, given that the U.S. runs an enormous trade deficit with the rest of the world and the U.S. dollar will inevitably weaken.

* The older charts I found provide data for the S&P/Barra 500 Value Index and the S&P/Barra 500 Value Index, instead of the S&P/Citi 500 Value and Growth Indices, respectively, during the time period from 1980-1986. I'm not sure whether the older S&P/Barra indices are substantially the same as the S&P/Citi indices, but they appear to be so.

*** Edit - January 21, 2014 ***

I have updated this chart with results through 2013.

While sleuthing around on the Internet I came across some old versions of the Callan Periodic Table of Investment Returns that I have posted previously. I entered all of the data I found from 1980-2006 into a spreadsheet for small cap indices (Russell 2000, Russell 2000 Value, and Russell 2000 Growth), large cap indices (S&P 500, S&P/Citi 500 Value*, and S&P/Citi 500 Growth*), a broad-based foreign stock index(Morgan Stanley Capital International Index for the developed stock markets of Europe, Australasia, and the Far East ("MSCI EAFE index")), and an index of bonds (Lehman Brothers Aggregate Bond Index ("LB Agg.")).

As shown in the chart below (click on the image for a larger view), the Russell 2000 Value index has outperformed all other investment styles over the time frame, returning 4522.32%, which is an average annual return of 15.26%. The Russell 2000 Growth Index was the worst performer, on the other hand, providing a total return of just 937.98% over the time period, or about 9.05% per year. The formidable return of the Russell 2000 Value index is not surprising, considering that Small Cap Value stocks have routinely outperformed other investment styles over long periods of time as I have previously discussed.

What is surprising is just how poor the returns were for the Small Cap Growth stocks in the Russell 2000 Growth index - for all of the risk involved, investors are not adequately compensated, seeing as how the LB Agg. Index returned 948.45% over the time period, an average annual return of about 9.09% with far less risk.

Another thing I found surprising is that the S&P 500 Index provided much larger returns that the overall Russell 2000 Index. Small cap stocks absolutely trounced large caps during the 1970s, so I guess this is to be expected.

An additional item of interest is the return of the MSCI EAFE Index versus the S&P 500. As shown, the MSCI EAFE Index returned 1849.57%, or an average annual return of 11.63% during the time period. The S&P 500 provided much larger returns - a total return of 2802.82%, or an average of 13.29% between 1980 and 2006. I expect that the MSCI EAFE Index will catch up to the S&P 500's performance in the future, given that the U.S. runs an enormous trade deficit with the rest of the world and the U.S. dollar will inevitably weaken.

* The older charts I found provide data for the S&P/Barra 500 Value Index and the S&P/Barra 500 Value Index, instead of the S&P/Citi 500 Value and Growth Indices, respectively, during the time period from 1980-1986. I'm not sure whether the older S&P/Barra indices are substantially the same as the S&P/Citi indices, but they appear to be so.

*** Edit - January 21, 2014 ***

I have updated this chart with results through 2013.

Friday, January 12, 2007

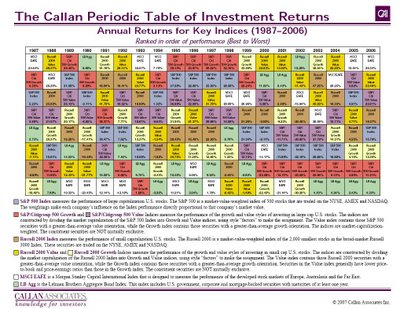

Updated "Periodic Table" of Equity Style Investment Returns Through 2006

Posted below is an updated version of the "Periodic Table" of equity style investment returns from 1987-2006. (Click on the image below to see a larger version of the Periodic Table.) This chart was originally posted on the website for Callan Associates.

*If the image is fuzzy, you can see a .pdf of the image here.

I have written a new post with results from 1989-2008.

*If the image is fuzzy, you can see a .pdf of the image here.

I have written a new post with results from 1989-2008.

Thursday, January 04, 2007

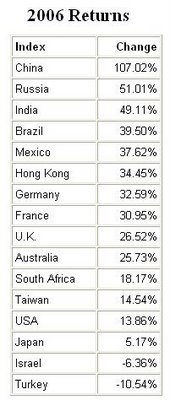

2006 Global Stock Market Returns

The Wall Street Journal Online has an interesting article about 2006 global stock market returns. The U.S. had respectable returns of about 13.86% during 2006, but this pales in comparison to the returns of the stock markets of many other countries, including the BRIC countries of Brazil, Russia, India, and China, as shown in the chart below:

Wednesday, January 03, 2007

The First BRIC ETF Was Launched In September

In 2003 Goldman Sachs published a report on the top emerging markets for the next 50 years - Brazil, Russia, India, and China (collectively known as "BRIC"). In the report Goldman Sachs projected that the BRIC countries will grow much faster than any of the current developed markets (including the U.S., Japan, Germany, the U.K., Italy, and France) and the local currencies of the BRIC countries will appreciate some 100-300% against those of the developed markets.

I have been waiting for an ETF to be introduced that invests only in the BRIC countries. Unfortunately there was none until very recently. The best that a small investor could do was to purchase a broad-based emerging markets ETF such as the iShares MSCI Emerging Markets Index Fund ("EEM") that invests in the BRIC countries as well as many other countries, including South Korea and Taiwan. Alternatively, one could also invest in country-specific ETFs and closed-end funds, such as the iShares MSCI Brazil Index Fund ("EWZ"), iShares FTSE/Xinhua China 25 Index Fund ("FXI"), Templeton Russia & East European Fund ("TRF"), and Morgan Stanley India Investment Fund ("IIF").

Luckily, the first BRIC ETF has finally been introduced. During mid-September 2006, the Claymore BRIC ETF was unveiled. The Claymore BRIC ETF invests solely in the BRIC countries and tracks the Bank of New York's BRIC Select ADR Index. Unfortunately, the BRIC ETF does not invest evenly in the BRIC countries - about 48% of the assets are in Brazil, 31% in China, close to 14% in India, but just 6% in Russia. Moreover, the ETF's assets are highly concentrated among a handful of stocks - the ETF owns both common and preferred shares of the Brazilian company Petroleo Brasileiro (symbol: PBR) totaling 15.53% of the ETF's net assets.

Although I am glad to finally see a BRIC ETF, I'm going to sit on the sidelines. I don't like the uneven investment in the BRIC countries, with the investment in Brazilian companies being nearly eight times as large as the investment in Russian stocks. For the time being, I will continue to invest in EEM and the country-specific ETFs and country-specific closed-end funds I listed above.

I have been waiting for an ETF to be introduced that invests only in the BRIC countries. Unfortunately there was none until very recently. The best that a small investor could do was to purchase a broad-based emerging markets ETF such as the iShares MSCI Emerging Markets Index Fund ("EEM") that invests in the BRIC countries as well as many other countries, including South Korea and Taiwan. Alternatively, one could also invest in country-specific ETFs and closed-end funds, such as the iShares MSCI Brazil Index Fund ("EWZ"), iShares FTSE/Xinhua China 25 Index Fund ("FXI"), Templeton Russia & East European Fund ("TRF"), and Morgan Stanley India Investment Fund ("IIF").

Luckily, the first BRIC ETF has finally been introduced. During mid-September 2006, the Claymore BRIC ETF was unveiled. The Claymore BRIC ETF invests solely in the BRIC countries and tracks the Bank of New York's BRIC Select ADR Index. Unfortunately, the BRIC ETF does not invest evenly in the BRIC countries - about 48% of the assets are in Brazil, 31% in China, close to 14% in India, but just 6% in Russia. Moreover, the ETF's assets are highly concentrated among a handful of stocks - the ETF owns both common and preferred shares of the Brazilian company Petroleo Brasileiro (symbol: PBR) totaling 15.53% of the ETF's net assets.

Although I am glad to finally see a BRIC ETF, I'm going to sit on the sidelines. I don't like the uneven investment in the BRIC countries, with the investment in Brazilian companies being nearly eight times as large as the investment in Russian stocks. For the time being, I will continue to invest in EEM and the country-specific ETFs and country-specific closed-end funds I listed above.

Monday, January 01, 2007

December 2006 Returns For My Model Long-Term Portfolio

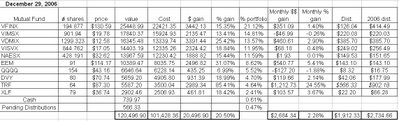

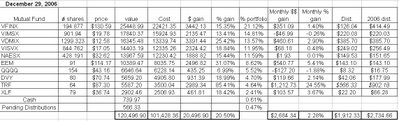

December was yet another solid month for my Hypothetical Model Portfolio. As of the market close on December 29, 2006, the Hypothetical Model Portfolio* increased in value by $2684.34, or about 2.28% during the month of December. The Hypothetical Model Portfolio closed up $20,496.90 in 2006, a gain of about 20.50%, as shown on the table below (click for a larger image of the table).

Emerging markets led the way in December and were the overall winners in my portfolio for the 2006-year. The Templeton Russia closed-end fund (TRF) rose over 24% in December and finished 2006 up a whopping 85%, and the iShares Emerging Markets ETF (EEM) returned about 5.4%, finishing the year up just over 31%. My third-best performer in 2006 was the Vanguard Developed Markets Index mutual fund (VDMIX), which rose about 2.9% in December and finished 2006 up about 25.4%. Dividend-paying stocks also performed well during December, with S&P 500 Financial components ETF (XLF) returning about 3.6% and the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) rising about 2.1%.

As discussed above, the foreign holdings (i.e., TRF, EEM, and VDMIX) powered the portfolio during 2006. The only real dog of the portfolio was the Nasdaq 100 ETF (QQQQ), which rose just under 7% during 2006, trailing the overall performance of the portfolio by about 13.5%.

Nine of the ten holdings in the portfolio paid distributions during December. TRF was the only holding to not pay a distribution. However, distributions were deducted from the share price for TRF at the end of December. The TRF distributions will be paid out during the middle of January. Because the distribution is large (greater than $500), I have included the January 2007 TRF distributions in the December 2006 returns for TRF and labeled them "pending distributions."

Regarding the rest of the holdings, the dividends from mutual fund holdings were reinvested, but the dividends from the ETFs were not reinvested- they were accumulated as "CASH" on the performance table below, for the reasons set forth in a previous post. The Vanguard S&P 500 Index fund (VFINX) paid a dividend of $0.65/share (a total of $126.04), which was reinvested on December 27th to purchase an additional 0.966 shares at a price of $130.43/share. The Vanguard Mid Cap Index Fund (VIMSX) paid a dividend of $0.247/share (a total of $220.03), which was reinvested on December 22nd to purchase an additional 11.135 shares at a price of $19.76/share. The Vanguard Developed Markets Index mutual fund (VDMIX) paid a dividend of $0.299/share and a short-term capital gain of $0.005/share (a total of $385.70), which was reinvested on December 29th to purchase an additional 30.563 shares at a price of $12.62/share. The Vanguard Small Cap Value Index (VISVX) paid a dividend of $0.30/share (a total of $249.02), which was reinvested on December 22nd to purchase an additional 14.709 shares at a price of $16.93/share. The Vanguard Small Cap Index (NAESX) paid a dividend of $0.353/share (a total of $149.53), which was reinvested on December 22nd to purchase an additional 4.604 shares at a price of $32.48/share.

The ETFs listed below each paid a distribution that was invested in "CASH" as shown in the chart below. EEM paid a dividend of $1.57251/share (a total of $143.10) on December 29th. QQQQ paid a dividend of $0.054/share (a total of $8.32) on December 29th. DVY paid a dividend of $0.52572/share (a total of $42.06) on December 27th. XLF paid a dividend of $0.28103/share (a total of $22.20) on December 27th. Finally, a distribution of $8.8489 was deducted from the TRF share price on December 27th and will be paid on January 16, 2006.

My Hypothetical Model Portfolio beat the S&P 500 index by about 5 percentage points during 2006. This is an impressive performance. I concede that the Hypothetical Model Portfolio will underperform the S&P 500 index from time-to-time, but it should outperform the S&P 500 index over the long-term. For the 2007 investing year, I intend to add another $25,000 to the Hypothetical Model Portfolio and invest this money and the money listed as "CASH" below according to the same allocations as were outlined in my original post in which I introduced my Hypothetical Model Portfolio. I will discuss the purchase of new shares in a subsequent post.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

November 2006 Returns

Emerging markets led the way in December and were the overall winners in my portfolio for the 2006-year. The Templeton Russia closed-end fund (TRF) rose over 24% in December and finished 2006 up a whopping 85%, and the iShares Emerging Markets ETF (EEM) returned about 5.4%, finishing the year up just over 31%. My third-best performer in 2006 was the Vanguard Developed Markets Index mutual fund (VDMIX), which rose about 2.9% in December and finished 2006 up about 25.4%. Dividend-paying stocks also performed well during December, with S&P 500 Financial components ETF (XLF) returning about 3.6% and the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) rising about 2.1%.

As discussed above, the foreign holdings (i.e., TRF, EEM, and VDMIX) powered the portfolio during 2006. The only real dog of the portfolio was the Nasdaq 100 ETF (QQQQ), which rose just under 7% during 2006, trailing the overall performance of the portfolio by about 13.5%.

Nine of the ten holdings in the portfolio paid distributions during December. TRF was the only holding to not pay a distribution. However, distributions were deducted from the share price for TRF at the end of December. The TRF distributions will be paid out during the middle of January. Because the distribution is large (greater than $500), I have included the January 2007 TRF distributions in the December 2006 returns for TRF and labeled them "pending distributions."

Regarding the rest of the holdings, the dividends from mutual fund holdings were reinvested, but the dividends from the ETFs were not reinvested- they were accumulated as "CASH" on the performance table below, for the reasons set forth in a previous post. The Vanguard S&P 500 Index fund (VFINX) paid a dividend of $0.65/share (a total of $126.04), which was reinvested on December 27th to purchase an additional 0.966 shares at a price of $130.43/share. The Vanguard Mid Cap Index Fund (VIMSX) paid a dividend of $0.247/share (a total of $220.03), which was reinvested on December 22nd to purchase an additional 11.135 shares at a price of $19.76/share. The Vanguard Developed Markets Index mutual fund (VDMIX) paid a dividend of $0.299/share and a short-term capital gain of $0.005/share (a total of $385.70), which was reinvested on December 29th to purchase an additional 30.563 shares at a price of $12.62/share. The Vanguard Small Cap Value Index (VISVX) paid a dividend of $0.30/share (a total of $249.02), which was reinvested on December 22nd to purchase an additional 14.709 shares at a price of $16.93/share. The Vanguard Small Cap Index (NAESX) paid a dividend of $0.353/share (a total of $149.53), which was reinvested on December 22nd to purchase an additional 4.604 shares at a price of $32.48/share.

The ETFs listed below each paid a distribution that was invested in "CASH" as shown in the chart below. EEM paid a dividend of $1.57251/share (a total of $143.10) on December 29th. QQQQ paid a dividend of $0.054/share (a total of $8.32) on December 29th. DVY paid a dividend of $0.52572/share (a total of $42.06) on December 27th. XLF paid a dividend of $0.28103/share (a total of $22.20) on December 27th. Finally, a distribution of $8.8489 was deducted from the TRF share price on December 27th and will be paid on January 16, 2006.

My Hypothetical Model Portfolio beat the S&P 500 index by about 5 percentage points during 2006. This is an impressive performance. I concede that the Hypothetical Model Portfolio will underperform the S&P 500 index from time-to-time, but it should outperform the S&P 500 index over the long-term. For the 2007 investing year, I intend to add another $25,000 to the Hypothetical Model Portfolio and invest this money and the money listed as "CASH" below according to the same allocations as were outlined in my original post in which I introduced my Hypothetical Model Portfolio. I will discuss the purchase of new shares in a subsequent post.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

November 2006 Returns

Subscribe to:

Posts (Atom)