I’ve been following the stock price of Home Depot (symbol: HD) on-and-off for about the past 10 years. There was a time in the late 90s when HD had a PE ratio in the 50s and traded as high as 70 back in April 2000. However, the investing world's view of large company growth stocks in general, and HD in particular, has radically changed over the past 6 years or so.

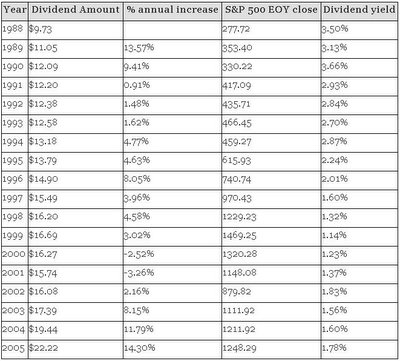

Take a look at this chart of fundamental data for HD from 1999-2005:

| 1999 | 2000

| 2001 | 2002 | 2003 | 2004

| 2005 |

Sales per share

| 16.68 | 19.68 | 22.83

| 25.40 | 27.31 | 33.86 | 37.95 |

"Cash flow" per share

| 1.21

| 1.37

| 1.62

| 1.99

| 2.27

| 2.93

| 3.45 |

Earnings per share

| 1.00

| 1.10

| 1.29

| 1.56

| 1.88 | 2.26

| 2.68 |

Dividends per share

| .11

| .16

| .17

| .21

| .26

| .33 | .40 |

Book Value per share

| 5.36

| 6.46

| 7.71

| 8.64

| 9.44

| 11.19 | 12.40 |

Common shares outstanding (millions)

| 2304.3

| 2323.7

| 2345.9

| 2293.0

| 2373.0

| 2158.7 | 2135.0 |

As one can see, HD's sales, cash flow, earnings per share, dividends, and book value have all risen substantially since 1999. Meanwhile, the number of shares outstanding has fallen due to an aggressive stock buyback plan.

A 168% increase in earnings per share since 1999 is astounding! The dividends almost quadrupled during the same time period. The dividend payouts are also increasing at an accelerated rate - HD

annouced in January that it is upped its dividend payout by 50% in 2006, to 60 cents per share.

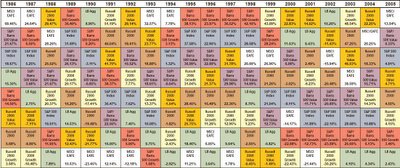

HD's stock price has not gone anywhere since the late 90s, despite the impressive improvement in HD's fundamentals during this time period. Money often flows in and out of certain sectors and styles of stocks from time-to-time. During the mid-late 90s, small company stocks were out of favor as investors focused on large company growth stocks. However, the tide shifted in 2000 and small company growth stocks have generally been favored over large company growth stocks for the past 6 years. However, this trend will eventually reverse itself as it always does.

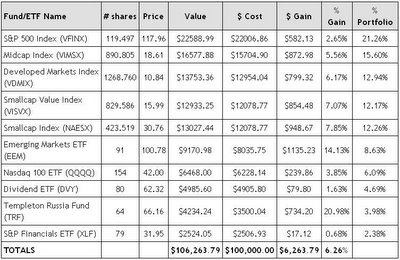

Wall Street can only ignore HD for so long. Its PE ratio is as low as its been since at least the mid 80s, as one can see in this

report from the Value Line. Based on 2006 estimated earnings of $3 per share, HD currently has a rock-bottom forward PE ratio of about 13. It would not surprise me to see its forward PE ratio expand to about 20 over a period of 12-18 months. I do not know when the money will flow back into HD, but it seems inevitable that investors will return. When they do, look for HD to rocket.