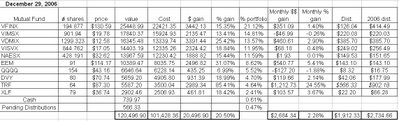

Emerging markets led the way in December and were the overall winners in my portfolio for the 2006-year. The Templeton Russia closed-end fund (TRF) rose over 24% in December and finished 2006 up a whopping 85%, and the iShares Emerging Markets ETF (EEM) returned about 5.4%, finishing the year up just over 31%. My third-best performer in 2006 was the Vanguard Developed Markets Index mutual fund (VDMIX), which rose about 2.9% in December and finished 2006 up about 25.4%. Dividend-paying stocks also performed well during December, with S&P 500 Financial components ETF (XLF) returning about 3.6% and the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) rising about 2.1%.

As discussed above, the foreign holdings (i.e., TRF, EEM, and VDMIX) powered the portfolio during 2006. The only real dog of the portfolio was the Nasdaq 100 ETF (QQQQ), which rose just under 7% during 2006, trailing the overall performance of the portfolio by about 13.5%.

Nine of the ten holdings in the portfolio paid distributions during December. TRF was the only holding to not pay a distribution. However, distributions were deducted from the share price for TRF at the end of December. The TRF distributions will be paid out during the middle of January. Because the distribution is large (greater than $500), I have included the January 2007 TRF distributions in the December 2006 returns for TRF and labeled them "pending distributions."

Regarding the rest of the holdings, the dividends from mutual fund holdings were reinvested, but the dividends from the ETFs were not reinvested- they were accumulated as "CASH" on the performance table below, for the reasons set forth in a previous post. The Vanguard S&P 500 Index fund (VFINX) paid a dividend of $0.65/share (a total of $126.04), which was reinvested on December 27th to purchase an additional 0.966 shares at a price of $130.43/share. The Vanguard Mid Cap Index Fund (VIMSX) paid a dividend of $0.247/share (a total of $220.03), which was reinvested on December 22nd to purchase an additional 11.135 shares at a price of $19.76/share. The Vanguard Developed Markets Index mutual fund (VDMIX) paid a dividend of $0.299/share and a short-term capital gain of $0.005/share (a total of $385.70), which was reinvested on December 29th to purchase an additional 30.563 shares at a price of $12.62/share. The Vanguard Small Cap Value Index (VISVX) paid a dividend of $0.30/share (a total of $249.02), which was reinvested on December 22nd to purchase an additional 14.709 shares at a price of $16.93/share. The Vanguard Small Cap Index (NAESX) paid a dividend of $0.353/share (a total of $149.53), which was reinvested on December 22nd to purchase an additional 4.604 shares at a price of $32.48/share.

The ETFs listed below each paid a distribution that was invested in "CASH" as shown in the chart below. EEM paid a dividend of $1.57251/share (a total of $143.10) on December 29th. QQQQ paid a dividend of $0.054/share (a total of $8.32) on December 29th. DVY paid a dividend of $0.52572/share (a total of $42.06) on December 27th. XLF paid a dividend of $0.28103/share (a total of $22.20) on December 27th. Finally, a distribution of $8.8489 was deducted from the TRF share price on December 27th and will be paid on January 16, 2006.

My Hypothetical Model Portfolio beat the S&P 500 index by about 5 percentage points during 2006. This is an impressive performance. I concede that the Hypothetical Model Portfolio will underperform the S&P 500 index from time-to-time, but it should outperform the S&P 500 index over the long-term. For the 2007 investing year, I intend to add another $25,000 to the Hypothetical Model Portfolio and invest this money and the money listed as "CASH" below according to the same allocations as were outlined in my original post in which I introduced my Hypothetical Model Portfolio. I will discuss the purchase of new shares in a subsequent post.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

November 2006 Returns

No comments:

Post a Comment