Saturday, December 12, 2009

Website With Short Interest Information

I recently discovered an interesting website that contains short interest information for stocks, ETFs, and closed-end funds. Shortsqueeze.com has a search engine and lists the number of outstanding shares and the float of a particular equity or fund and the number of shares that have been sold short. Short interest information is relevant to any investor considering selling short an equity or fund.

Sunday, October 11, 2009

Update on Arbitrage Strategy for Trading the Templeton Russia & East European Fund

Back on May 10, 2009 I discussed an arbitrage strategy for profiting from the inevitable compression in the net asset value ("NAV") premium of the Templeton Russia & East European Fund (symbol: TRF). At the time, TRF had closed at $19.00/share and had a NAV of $10.56 during the previous day of trading, Friday, May 8, 2009. Accordingly, TRF was trading at $8.44 above its NAV of $10.56, a premium of 79%.

TRF has usually traded at a premium to its NAV ever since its inception back in 1995. However, the premium was typically around 20% above the NAV. Accordingly, I was certain that TRF's 79% premium on May 8, 2009 would likely compress in the near future. I recommended an arbitrage strategy involving selling short shares of TRF and establishing a corresponding long position in the Market Vectors TR Russia ETF (symbol: RSX). I recommended the long position in RSX because RSX tracks the benchmark DAXglobal Russia+ Index. At the time of my previous post, RSX had closed at $20.62 and TRF closed at $19.00 on Friday, May 8, 2009. Based on those closing prices, one could have generated a hedged position between RSX and TRF by selling short 2062 shares of TRF and purchasing 1900 shares of TRF.

Anyone who followed my advice should now cover the short position in TRF and sell the long position in RSX. TRF's premium has shrunk from 79% to 18%. Between the market close on Friday, May 8, 2009 and market close on Friday, October 9, 2009, TRF's NAV increased from $10.56 to $16.61, a gain of about 57.3%. However, because TRF's premium compressed substantially during the time period, the share price of TRF merely increased from $19.00 to $19.72, a gain of just about 3.8%. The share price of RSX, on the other hand, increased from $20.62 to $30.25, a gain of about 46.7%. The chart below (click on the image for a larger view) shows the performance of TRF versus RSX between May 8, 2009 and October 9, 2009.

Because the share price of RSX gained 46.7% versus a gain of just 3.8% for TRF, a substantial profit could have been made by implementing my arbitrage strategy. The long position of 1900 shares of RSX would be worth $18,292.00 more and the short position of 2062 would be worth $1,489.64 less than they were on October 8, 2009. Accordingly, summing the gain from the long RSX position and the loss from the short TRF position yields and overall gain of $16,802.36.

Because the share price of RSX gained 46.7% versus a gain of just 3.8% for TRF, a substantial profit could have been made by implementing my arbitrage strategy. The long position of 1900 shares of RSX would be worth $18,292.00 more and the short position of 2062 would be worth $1,489.64 less than they were on October 8, 2009. Accordingly, summing the gain from the long RSX position and the loss from the short TRF position yields and overall gain of $16,802.36.

Of course, there are trading fees and margin fees for which one needs to account. If the trades had been made through a brokerage offering low margin fees, such as Trading Direct, each trade would have cost $10 and the margin rate during the five-month period between May 8, 2009 and October 9, 2009 would have been 3.75%. The total trading fees would therefore have been $40.00 (for each purchase and sell of TRF and RSX, respectively) and the margin fees would have been about $606.*

After accounting for all trading fees and margin fees, the net overall profit would have been an impressive $16,156,36. In short, this would have been a supremely profitable arbitrage strategy!

* I calculated the margin rate over a period of approximately exactly five months between May 8, 2009 and October 9, 2009 to be 1.0375^(5/12), or 1.54574%. The total that would have been borrowed to purchase the long position in RSX would have been $39198 - the cost to purchase 1900 shares of RSX at $20.62 plus the $20 in initial trading fees to purchase RSX and sell short TRF.

TRF has usually traded at a premium to its NAV ever since its inception back in 1995. However, the premium was typically around 20% above the NAV. Accordingly, I was certain that TRF's 79% premium on May 8, 2009 would likely compress in the near future. I recommended an arbitrage strategy involving selling short shares of TRF and establishing a corresponding long position in the Market Vectors TR Russia ETF (symbol: RSX). I recommended the long position in RSX because RSX tracks the benchmark DAXglobal Russia+ Index. At the time of my previous post, RSX had closed at $20.62 and TRF closed at $19.00 on Friday, May 8, 2009. Based on those closing prices, one could have generated a hedged position between RSX and TRF by selling short 2062 shares of TRF and purchasing 1900 shares of TRF.

Anyone who followed my advice should now cover the short position in TRF and sell the long position in RSX. TRF's premium has shrunk from 79% to 18%. Between the market close on Friday, May 8, 2009 and market close on Friday, October 9, 2009, TRF's NAV increased from $10.56 to $16.61, a gain of about 57.3%. However, because TRF's premium compressed substantially during the time period, the share price of TRF merely increased from $19.00 to $19.72, a gain of just about 3.8%. The share price of RSX, on the other hand, increased from $20.62 to $30.25, a gain of about 46.7%. The chart below (click on the image for a larger view) shows the performance of TRF versus RSX between May 8, 2009 and October 9, 2009.

Of course, there are trading fees and margin fees for which one needs to account. If the trades had been made through a brokerage offering low margin fees, such as Trading Direct, each trade would have cost $10 and the margin rate during the five-month period between May 8, 2009 and October 9, 2009 would have been 3.75%. The total trading fees would therefore have been $40.00 (for each purchase and sell of TRF and RSX, respectively) and the margin fees would have been about $606.*

After accounting for all trading fees and margin fees, the net overall profit would have been an impressive $16,156,36. In short, this would have been a supremely profitable arbitrage strategy!

* I calculated the margin rate over a period of approximately exactly five months between May 8, 2009 and October 9, 2009 to be 1.0375^(5/12), or 1.54574%. The total that would have been borrowed to purchase the long position in RSX would have been $39198 - the cost to purchase 1900 shares of RSX at $20.62 plus the $20 in initial trading fees to purchase RSX and sell short TRF.

Friday, July 03, 2009

Historical Annual Returns for the S&P 500 Index - Updated Through 2008

Last November I posted charts of historical annual returns for the S&P 500 and its precursor S&P 90 Index from January 1926 - November 2008. Some people have been emailing me to ask me to update the charts with full year returns for 2008. Updated charts are shown in the two images below (click on each image for a larger view).

As shown below, 2008 was an awful year for the S&P 500 Index and was the second worst annual return since 1926. The only year with a worse performance was 1934, during the midst of the Great Depression, when the index dropped about 43.34%.

The 5-year annualized return through the end of 2008 was -2.19%, the worst it has been since 1941, during World War II, when the annualized 5-year return was about -7.51%. The 10-year annualized return of about -1.39% was the worst it has ever been based on the data I have back through 1926!

The S&P 500 Index is up slightly through the first six months of 2009. I'm uncertain as to whether the stock market has finally stabilized. The current U.S. recession is worsening and if things continue to get much worse, it wouldn't surprise me to see the S&P 500 Index breach the lows it reached back in March 2009.

I have posted an updated chart for the returns of the S&P 500 Index during the period between 1926-2015.

As shown below, 2008 was an awful year for the S&P 500 Index and was the second worst annual return since 1926. The only year with a worse performance was 1934, during the midst of the Great Depression, when the index dropped about 43.34%.

The 5-year annualized return through the end of 2008 was -2.19%, the worst it has been since 1941, during World War II, when the annualized 5-year return was about -7.51%. The 10-year annualized return of about -1.39% was the worst it has ever been based on the data I have back through 1926!

The S&P 500 Index is up slightly through the first six months of 2009. I'm uncertain as to whether the stock market has finally stabilized. The current U.S. recession is worsening and if things continue to get much worse, it wouldn't surprise me to see the S&P 500 Index breach the lows it reached back in March 2009.

I have posted an updated chart for the returns of the S&P 500 Index during the period between 1926-2015.

Friday, June 19, 2009

2009 Lincoln Pennies

I have previously discussed the 2009 Lincoln penny, which features four new designs to celebrate President Abraham Lincoln's 200th birthday and the 100th anniversary of the first Lincoln penny. The designs on the 2009 penny will only be used this year - new designs will be featured on pennies in 2010 and during subsequent years.

The first 2009 penny design, featuring a design commemorating Lincoln's birth and early childhood in Kentucky, was released on February 12, 2009. I live in Chicago, IL, and I have yet to see any 2009 pennies having this first design. Apparently 634 million pennies having this design were minted, but I have yet to see one in circulation.

The second penny design, featuring a design commemorating Lincoln's formative years in Indiana, was released on May 14, 2009. I recently received pennies featuring this design as change at my local grocery store. I went straight to my bank after receiving those pennies in change and was able to purchase 10 uncirculated rolls of the 2009 pennies with the second design.

As far as I can tell, many people have been hoarding 2009 pennies. Collectors have been purchasing rolls of the 2009 pennies from banks and consumers receiving the 2009 pennies in change are also saving them. Demand for the 2009 pennies is very high and collectors have been selling 2009 pennies on eBay at prices above the 1-cent face value of the pennies.

As far as I can tell, many people have been hoarding 2009 pennies. Collectors have been purchasing rolls of the 2009 pennies from banks and consumers receiving the 2009 pennies in change are also saving them. Demand for the 2009 pennies is very high and collectors have been selling 2009 pennies on eBay at prices above the 1-cent face value of the pennies.

The mintage for the 2009 pennies is far lower than it has been in years past. I have read that because the U.S. economy in mired in a deep recession, people having been using the change that they have accumulated over the years to either purchase goods or to deposit into their bank accounts. As a result, there are many more old coins in circulation right now than there has been in years past. Consequently, the U.S. Mint has been minting far fewer coins than it has in previous years.

The mintage of 2009 pennies is supposedly going to be maybe 25% of what it has been in recent years. The combination of relatively low mintage combined with the high demand by collectors for the 2009 pennies means that they are very hard to find. Anyone who has at least somewhat of a passing interest in coin collecting should seriously consider saving 2009 pennies if that person ever receives such pennies as change for a purchase.

The first 2009 penny design, featuring a design commemorating Lincoln's birth and early childhood in Kentucky, was released on February 12, 2009. I live in Chicago, IL, and I have yet to see any 2009 pennies having this first design. Apparently 634 million pennies having this design were minted, but I have yet to see one in circulation.

The second penny design, featuring a design commemorating Lincoln's formative years in Indiana, was released on May 14, 2009. I recently received pennies featuring this design as change at my local grocery store. I went straight to my bank after receiving those pennies in change and was able to purchase 10 uncirculated rolls of the 2009 pennies with the second design.

As far as I can tell, many people have been hoarding 2009 pennies. Collectors have been purchasing rolls of the 2009 pennies from banks and consumers receiving the 2009 pennies in change are also saving them. Demand for the 2009 pennies is very high and collectors have been selling 2009 pennies on eBay at prices above the 1-cent face value of the pennies.

As far as I can tell, many people have been hoarding 2009 pennies. Collectors have been purchasing rolls of the 2009 pennies from banks and consumers receiving the 2009 pennies in change are also saving them. Demand for the 2009 pennies is very high and collectors have been selling 2009 pennies on eBay at prices above the 1-cent face value of the pennies.The mintage for the 2009 pennies is far lower than it has been in years past. I have read that because the U.S. economy in mired in a deep recession, people having been using the change that they have accumulated over the years to either purchase goods or to deposit into their bank accounts. As a result, there are many more old coins in circulation right now than there has been in years past. Consequently, the U.S. Mint has been minting far fewer coins than it has in previous years.

The mintage of 2009 pennies is supposedly going to be maybe 25% of what it has been in recent years. The combination of relatively low mintage combined with the high demand by collectors for the 2009 pennies means that they are very hard to find. Anyone who has at least somewhat of a passing interest in coin collecting should seriously consider saving 2009 pennies if that person ever receives such pennies as change for a purchase.

Sunday, May 10, 2009

An Arbitrage Strategy for Trading the Templeton Russia & East European Fund

I have previously recommended the Templeton Russia & East European Fund (symbol: TRF) as the best means for small investors to invest in Russian equities. Back when I made my recommendation in 2005, there was no suitable ETF that focused on Russian equities.

However, in late April 2007, the first ETF focused on Russian equities was introduced. The name of the ETF is the Market Vectors TR Russia ETF (symbol: RSX). RSX tracks the benchmark DAXglobal Russia+ Index. According to ETFconnect, the DAXglobal Russia+ Index is comprised of companies with market capitalization greater than 150 million dollars that have a daily average traded volume of at least 1 million dollar over the past six months.

I now firmly believe that as between RSX and TRF, RSX is a far superior investment product. First, RSX has a lower expense ratio (0.69% versus 1.70%). Second, because TRF is a closed-end fund, it will typically trade at a premium or discount to its net asset value (NAV). As I have discussed in the past, TRF typically trades at a premium, but the amount of the premium can vary dramatically. In 2007, for example, the NAV of TRF increased 18.74%, but the share price dropped 1.33% because the premium plummeted over 30% at the beginning of 2007 to less than 10% by the end of 2007.

As of the close of the stock market on Friday, May 8, 2009, TRF had a NAV of $10.56 and a share price of $19.00. TRF therefore trades at a 79% premium above its NAV. That premium is not sustainable and I cannot determine why anyone who pay a 79% premium for TRF when there is a perfectly suitable ETF alternative available, i.e., RSX. I suspect that day traders are bidding TRF up to unsustainable levels. According to the Franklin Templeton website, TRF only has 4.6 million shares outstanding. Given its small float, TRF is a ripe target for momentum investors such as day traders - e.g., because it has so few outstanding shares, small investors may be able to greatly affect the daily price of TRF.

I firmly believe that TRF's premium will eventually disappear and its share price will eventually trade around its NAV, as it has in the recent past. As recently as November 30, 2008, for example, TRF actually traded at a discount of 5.87%!

A potential arbitrage opportunity exists which would allow one to profit from the inevitable decrease in the share premium for TRF. Specifically, by selling short TRF and establishing a long position in RSX, one could effectively profit on the eventually premium compression. RSX and TRF invest in a similar, although not the same, mix of Russian equities. There is a strong correlation between appreciation of TRF's NAV and movements in the share price for RSX.

RSX closed at $20.62 and TRF closed at $19.00 on Friday, May 8, 2009. Based on closing prices, one could generate a hedged position between RSX and TRF by selling short 2062 shares of TRF and purchasing 1900 shares of TRF. If the $8.44 premium of TRF were to shrink or disappear entirely, one would would make a substantial profit after transaction fees.

However, in late April 2007, the first ETF focused on Russian equities was introduced. The name of the ETF is the Market Vectors TR Russia ETF (symbol: RSX). RSX tracks the benchmark DAXglobal Russia+ Index. According to ETFconnect, the DAXglobal Russia+ Index is comprised of companies with market capitalization greater than 150 million dollars that have a daily average traded volume of at least 1 million dollar over the past six months.

I now firmly believe that as between RSX and TRF, RSX is a far superior investment product. First, RSX has a lower expense ratio (0.69% versus 1.70%). Second, because TRF is a closed-end fund, it will typically trade at a premium or discount to its net asset value (NAV). As I have discussed in the past, TRF typically trades at a premium, but the amount of the premium can vary dramatically. In 2007, for example, the NAV of TRF increased 18.74%, but the share price dropped 1.33% because the premium plummeted over 30% at the beginning of 2007 to less than 10% by the end of 2007.

As of the close of the stock market on Friday, May 8, 2009, TRF had a NAV of $10.56 and a share price of $19.00. TRF therefore trades at a 79% premium above its NAV. That premium is not sustainable and I cannot determine why anyone who pay a 79% premium for TRF when there is a perfectly suitable ETF alternative available, i.e., RSX. I suspect that day traders are bidding TRF up to unsustainable levels. According to the Franklin Templeton website, TRF only has 4.6 million shares outstanding. Given its small float, TRF is a ripe target for momentum investors such as day traders - e.g., because it has so few outstanding shares, small investors may be able to greatly affect the daily price of TRF.

I firmly believe that TRF's premium will eventually disappear and its share price will eventually trade around its NAV, as it has in the recent past. As recently as November 30, 2008, for example, TRF actually traded at a discount of 5.87%!

A potential arbitrage opportunity exists which would allow one to profit from the inevitable decrease in the share premium for TRF. Specifically, by selling short TRF and establishing a long position in RSX, one could effectively profit on the eventually premium compression. RSX and TRF invest in a similar, although not the same, mix of Russian equities. There is a strong correlation between appreciation of TRF's NAV and movements in the share price for RSX.

RSX closed at $20.62 and TRF closed at $19.00 on Friday, May 8, 2009. Based on closing prices, one could generate a hedged position between RSX and TRF by selling short 2062 shares of TRF and purchasing 1900 shares of TRF. If the $8.44 premium of TRF were to shrink or disappear entirely, one would would make a substantial profit after transaction fees.

Saturday, May 02, 2009

1989-2008 Annual Returns for Select Developed Markets

The chart below illustrates annual returns between 1989 and 2008 for select developed foreign markets. The chart shows the returns for the various MS country indices for Australia, Canada, France, Germany, Hong Kong, Japan, Switzerland, and the United Kingdom. As references, the chart also includes annual returns (in terms of U.S. Dollars) for the MSCI EAFE Index of foreign developed markets and for the U.S., as represented by the S&P 500 Index.

Many investors invest at least part of their stock market portfolio in foreign stocks, such as emerging markets and/or foreign developed markets. The most widely followed index of foreign developed markets is the MSCI EAFE Index. As I have previously mentioned, the U.S. Dollar will likely continue to weaken over time versus foreign currencies as a result of ongoing budget and trade deficits.

As shown in the chart below, the MSCI EAFE Index provided a meager cumulative return of about 85.70% between 1989 and 2008, an annualized return of just about 3.14%. The returns of the MSCI EAFE Index were dragged down by the abysmal performance of the Japanese stocks. The MS Japan country index had a cumulative return of -39.51%, or an annualized return of -2.48% during the period tracked.

However, strong performances were realized by some of the foreign developed markets. As shown, the MS Switzerland Index realized an impressive cumulative return of about 648%, or about 10.52% per year. Hong Kong was another strong performer, returning about 569%, or 9.98% per year.

Some of the weaker performances were realized by the United Kingdom and Australia. The MS United Kingdom country Index returned a total of about 268%, or 6.74% per year. The MS Australia country Index, on the other hand, returned a total of about 274%, or 6.83% per year.

U.S. stocks performed well in comparison to the foreign developed markets tracked, beating all of the foreign markets tracked except for Switzerland and Hong Kong. The S&P 500 Index returned a total of about 404%, or about 8.42% per year during the period tracked.

Many investors invest at least part of their stock market portfolio in foreign stocks, such as emerging markets and/or foreign developed markets. The most widely followed index of foreign developed markets is the MSCI EAFE Index. As I have previously mentioned, the U.S. Dollar will likely continue to weaken over time versus foreign currencies as a result of ongoing budget and trade deficits.

As shown in the chart below, the MSCI EAFE Index provided a meager cumulative return of about 85.70% between 1989 and 2008, an annualized return of just about 3.14%. The returns of the MSCI EAFE Index were dragged down by the abysmal performance of the Japanese stocks. The MS Japan country index had a cumulative return of -39.51%, or an annualized return of -2.48% during the period tracked.

However, strong performances were realized by some of the foreign developed markets. As shown, the MS Switzerland Index realized an impressive cumulative return of about 648%, or about 10.52% per year. Hong Kong was another strong performer, returning about 569%, or 9.98% per year.

Some of the weaker performances were realized by the United Kingdom and Australia. The MS United Kingdom country Index returned a total of about 268%, or 6.74% per year. The MS Australia country Index, on the other hand, returned a total of about 274%, or 6.83% per year.

U.S. stocks performed well in comparison to the foreign developed markets tracked, beating all of the foreign markets tracked except for Switzerland and Hong Kong. The S&P 500 Index returned a total of about 404%, or about 8.42% per year during the period tracked.

Tuesday, April 07, 2009

Recession Era Car Insurance: Get Aggressive About Discounts

In these tough economic times, cutting expenses isn’t just good sense, it’s a must. Drivers can’t do without car insurance; the law won’t let you. But there’s no law that says you have to pay through the nose when insuring your auto. When you start looking for an auto policy, remember these key points to do some deep “discount diving.”

Not all discounts are obvious.

Everyone knows that insurance companies like things like passive restraint systems and anti-theft devices, but most customers don’t know that in assessing risk, insurers also look at education and employment. People in the science and math fields, as well as engineers, have the lowest risk profiles and can actually get discounts of 10 to 30 percent on their policies. The same is true for educators, which is fairly common knowledge, but farming is the next lowest associated risk occupation. Bring it up. It never hurts to ask.

Service and experience are valuable.

Active duty and retired military personnel are eligible for discounts of 2 to 15 percent. (Service men and women who are going overseas can also decrease their coverage on stored vehicles.) Retirees often qualify for discounts of up to 45 percent if they have a good driving record and are members of AARP.

Buying in volume works for insurance too.

Taking out more than one type of insurance policy with the same insurance company is sure to garner discounts. Look for family rates if multiple drivers are to be insured, and ask about special programs for teen drivers. Some companies have new insurance products that will lower rates for drivers in this high risk category if a GPS tracking device controlled by the parent is installed on the vehicle.

Defensive driving isn’t just for when you get a ticket.

Often policy holders who will agree to take a defensive driving class will qualify for lower premiums. Now these courses are available online or via DVDs that can be rented in most video stores, minimizing the inconvenience. These days, the few hours spent on the course are well worth the dollars saved.

By aggressively seeking out little known discounts, being prepared to comparison shop for coverage, and not shying away from negotiation, insurance customers can reap the benefit of big savings. In the midst of a recession, when you’re lucky to be able to meet the car payment, there’s no reason to pay unnecessarily high rates for your auto policy.

Everyone knows that insurance companies like things like passive restraint systems and anti-theft devices, but most customers don’t know that in assessing risk, insurers also look at education and employment. People in the science and math fields, as well as engineers, have the lowest risk profiles and can actually get discounts of 10 to 30 percent on their policies. The same is true for educators, which is fairly common knowledge, but farming is the next lowest associated risk occupation. Bring it up. It never hurts to ask.

Active duty and retired military personnel are eligible for discounts of 2 to 15 percent. (Service men and women who are going overseas can also decrease their coverage on stored vehicles.) Retirees often qualify for discounts of up to 45 percent if they have a good driving record and are members of AARP.

Taking out more than one type of insurance policy with the same insurance company is sure to garner discounts. Look for family rates if multiple drivers are to be insured, and ask about special programs for teen drivers. Some companies have new insurance products that will lower rates for drivers in this high risk category if a GPS tracking device controlled by the parent is installed on the vehicle.

Often policy holders who will agree to take a defensive driving class will qualify for lower premiums. Now these courses are available online or via DVDs that can be rented in most video stores, minimizing the inconvenience. These days, the few hours spent on the course are well worth the dollars saved.

By aggressively seeking out little known discounts, being prepared to comparison shop for coverage, and not shying away from negotiation, insurance customers can reap the benefit of big savings. In the midst of a recession, when you’re lucky to be able to meet the car payment, there’s no reason to pay unnecessarily high rates for your auto policy.

Friday, March 27, 2009

Historical Returns for the MSCI Emerging Markets Index

The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index is one of the most widely-followed emerging markets equity indices. In the investment community, "Emerging Markets" typically refers to a social or business activity of nations that are in the process of rapid growth and industrialization.

There are currently 24 Emerging Markets tracked by the MSCI EM Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Of the tracked Emerging Markets, Brazil, Russia, India, and China (the "BRIC" countries) are arguably the markets with the greatest long-term growth potential.

The chart below lists annual returns for the MSCI EM Index between 1989 and 2008. Returns for the MSCI EM Index from 1993-1998 represent gross dividend reinvested returns, and returns from 1999-2008 represent net dividend reinvested return.* I acquired this data from a .pdf of returns for emerging markets that I found on the website for the Lazard Asset Management investment firm.

As shown, the MSCI EM Index has soared during some years and plummeted during others. In 1993, for example, the MSCI EM Index soared 74.83%, and the five-year annualized return between calendar years 2003-2007 was a whopping 37.02%. However, the MSCI EM Index has also occasionally posted abysmal returns. In 2008 the MSCI EM plummeted 53.33%, and the five-year annualized return of the MSCI EM Index between calendar years 1994-1998 was a pathetic -9.27%.

Despite the incredible volatility of annual returns, the overall annualized return of the MSCI EM Index between 1989 and 2008 was a decent 9.98%, and greatly exceeds the annualized return of 8.42% the S&P 500 Index over the same time period.

Emerging Markets can be an important portion of investment portfolio of any stock market investor. The economies of Emerging Markets typically grow much faster than those of Developed Markets, such as the United States. The performance of equity markets of such countries often has a strong correlation with the overall economic growth of such countries. Moreover, as I have discussed previously, the U.S. Dollar will likely continue to weaken in the future as the country becomes more and more dependent upon foreign investment.

However, given its inherent volatility, many investment advisers recommend limiting Emerging Markets to no more than 10-15% of an aggressive investor's portfolio.

* The performance data shown is slightly different than the performance data I saw for the MSCI EM Index at Index Universe, and I am not sure of the reason for the discrepancy.

** I have updated this chart to include returns for 2012 in another post.

There are currently 24 Emerging Markets tracked by the MSCI EM Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Of the tracked Emerging Markets, Brazil, Russia, India, and China (the "BRIC" countries) are arguably the markets with the greatest long-term growth potential.

The chart below lists annual returns for the MSCI EM Index between 1989 and 2008. Returns for the MSCI EM Index from 1993-1998 represent gross dividend reinvested returns, and returns from 1999-2008 represent net dividend reinvested return.* I acquired this data from a .pdf of returns for emerging markets that I found on the website for the Lazard Asset Management investment firm.

As shown, the MSCI EM Index has soared during some years and plummeted during others. In 1993, for example, the MSCI EM Index soared 74.83%, and the five-year annualized return between calendar years 2003-2007 was a whopping 37.02%. However, the MSCI EM Index has also occasionally posted abysmal returns. In 2008 the MSCI EM plummeted 53.33%, and the five-year annualized return of the MSCI EM Index between calendar years 1994-1998 was a pathetic -9.27%.

Despite the incredible volatility of annual returns, the overall annualized return of the MSCI EM Index between 1989 and 2008 was a decent 9.98%, and greatly exceeds the annualized return of 8.42% the S&P 500 Index over the same time period.

Emerging Markets can be an important portion of investment portfolio of any stock market investor. The economies of Emerging Markets typically grow much faster than those of Developed Markets, such as the United States. The performance of equity markets of such countries often has a strong correlation with the overall economic growth of such countries. Moreover, as I have discussed previously, the U.S. Dollar will likely continue to weaken in the future as the country becomes more and more dependent upon foreign investment.

However, given its inherent volatility, many investment advisers recommend limiting Emerging Markets to no more than 10-15% of an aggressive investor's portfolio.

* The performance data shown is slightly different than the performance data I saw for the MSCI EM Index at Index Universe, and I am not sure of the reason for the discrepancy.

** I have updated this chart to include returns for 2012 in another post.

Saturday, March 14, 2009

"Periodic Tables" of Investment Returns For Select Emerging Markets Through 1993- 2008

I have discovered interesting "periodic tables" of returns for select emerging markets during the years between 1993 and 2008. These charts (click on each chart for a larger view) are interesting and illustrate just how volatile and potentially rewarding investments in emerging markets can be.

Country-specific returns can be extremely volatile. For example, the Turkish stock market had some of the highest and lowest yearly returns for several years during the past 15 years. In 1993, Turkey returned of 207.75%, the highest of the tracked emerging markets. In 1994, however, Turkey had the lowest return of the tracked markets, dropping 52.56%.

I found these charts in a .pdf file on the website for Lazard Asset Management. According to the Lazard website, Lazard Asset Management provides investment management and advisory services to institutional clients, financial intermediaries, private clients and investment vehicles around the world.

Country-specific returns can be extremely volatile. For example, the Turkish stock market had some of the highest and lowest yearly returns for several years during the past 15 years. In 1993, Turkey returned of 207.75%, the highest of the tracked emerging markets. In 1994, however, Turkey had the lowest return of the tracked markets, dropping 52.56%.

I found these charts in a .pdf file on the website for Lazard Asset Management. According to the Lazard website, Lazard Asset Management provides investment management and advisory services to institutional clients, financial intermediaries, private clients and investment vehicles around the world.

Friday, March 13, 2009

Historical Returns for the S&P 400 Midcap Index (Updated Through 2008)

The S&P 400 Midcap Index is the most widely-followed of all U.S. Midcap stock market indices. Midcap stocks are generally defined as those of companies with market capitalizations between $1 billion and $10 billion. ("Market capitalization" refers to the value of outstanding shares of a particular stock.")

The S&P 400 Midcap Index was introduced in June 1991 by Standard & Poors to track the performance of U.S. mid cap stocks. Last year I posted a chart illustrating returns for the S&P 400 Midcap Index up through 2007. I updated the chart to reflect returns for 2008. The chart below illustrates the full year annual returns between 1992 and 2008.

As shown, the S&P 400 Midcap Index had its worst year annual returns in its existence, losing 36.23% in 2008. The terrible returns in 2008 dropped the annualized return from 1992 to 2008 down to 9.50%. This is a large decrease from the annualized return from 1992 to 2007 of 13.26%. The total return between 1992 and 2008 was 367.84%.

The chart below also shows five year annualized returns, starting with the fifth full calendar year of the existence of the S&P 400 Midcap Index (i.e., 1996). As shown, the highest annualized five-year return was 23.05% (between 1995 and 1999) and the lowest was -0.08% (between 2004 and 2008).

As I discussed last year, any long-term investor should seriously consider investing money in midcap stocks, such as those tracking the S&P 400 Midcap Index (e.g., the Midcap SPDR ETF (symbol: MDY) tracks the S&P 400 Midcap Index).

** I have posted an updated chart for the period between 1992-2014.

The S&P 400 Midcap Index was introduced in June 1991 by Standard & Poors to track the performance of U.S. mid cap stocks. Last year I posted a chart illustrating returns for the S&P 400 Midcap Index up through 2007. I updated the chart to reflect returns for 2008. The chart below illustrates the full year annual returns between 1992 and 2008.

As shown, the S&P 400 Midcap Index had its worst year annual returns in its existence, losing 36.23% in 2008. The terrible returns in 2008 dropped the annualized return from 1992 to 2008 down to 9.50%. This is a large decrease from the annualized return from 1992 to 2007 of 13.26%. The total return between 1992 and 2008 was 367.84%.

The chart below also shows five year annualized returns, starting with the fifth full calendar year of the existence of the S&P 400 Midcap Index (i.e., 1996). As shown, the highest annualized five-year return was 23.05% (between 1995 and 1999) and the lowest was -0.08% (between 2004 and 2008).

As I discussed last year, any long-term investor should seriously consider investing money in midcap stocks, such as those tracking the S&P 400 Midcap Index (e.g., the Midcap SPDR ETF (symbol: MDY) tracks the S&P 400 Midcap Index).

** I have posted an updated chart for the period between 1992-2014.

Saturday, January 31, 2009

Annualized Returns for Stock Market Indices By Decade (1980s - Present)

In my previous post, I discussed annual stock market and bond market returns for various indices for the time period from 1980-2008. Viewing annual returns since 1980 can be very illuminating and show the impressive effects of annual compounding of investment returns over time. However, even more information may be gleaned by viewing index returns on a decade-by-decade basis.

The chart below (click on the chart for a larger view) illustrates decade-by-decade returns for various stock and bond indices during the 1980s, 1990s, and 2000s (through 2008). The chart below illuistrates returns for small cap indices (Russell 2000, Russell 2000 Value, and Russell 2000 Growth), large cap indices (S&P 500, S&P/Citi 500 Value*, and S&P/Citi 500 Growth*), a broad-based foreign stock index (the Morgan Stanley Capital International Index for the developed stock markets of Europe, Australasia, and the Far East ("MSCI EAFE index")), an index of bonds (Lehman Brothers Aggregate Bond Index ("LB Agg.")), and the Nasdaq Composite Index.

Only three of the indices tracked have provided positive returns for each decade since the 1980s: the Russell 2000 Value, Russell 2000, and LB Agg. The Russell 2000 Value provided annualized returns of 17.44% during the 1980s, 12.45% during the 1990s, and 6.98% so far in the 2000s.

Only three of the indices tracked have provided positive returns for each decade since the 1980s: the Russell 2000 Value, Russell 2000, and LB Agg. The Russell 2000 Value provided annualized returns of 17.44% during the 1980s, 12.45% during the 1990s, and 6.98% so far in the 2000s.

As everyone now knows, there was a tremendous stock market bubble which accumulated throughout the 1990s. The Nasdaq Composite was one of the primary beneficiaries of the bubble valuations, rising a whopping annualized 24.5% throughout the 1990s, for a total return of about 794%. Such returns proved to be unsustainable, however, as the Nasdaq Composite has droppjavascript:void(0)ed a total of about 61% since 2000, for an annualized return during the 2000s (through 2008) of -10%.

The MSCI EAFE Index was also the beneficiary of a bubble, although it rose to lofty valuations during the Japan equity bubble of the 1980s. During the 1980s, the MSCI EAFE Index rose an impressive 630%, or about 22% on an annualized basis. Returns during the 1990s were far worse, with the MSCI EAFE Index rising only 96.99%, or about 7% per year. The MSCI has provided negative returns during the 2000s, dropping a total of 14.71%, or about 1.75% per year.

The S&P 500 Index provided strong and steady returns during the 1980s and 1990s until the U.S. stock market bubble burst in 2000. The S&P 500 Index returned about 403% during the 1980s and an additional 432% during the 1990s, for annualized returns during those decades of about 17.5% and 18.2%, respectively. The 2000s, however, have been far worse, with the index dropping 28% so far through 2008, for an annualized return of about -3.6%.

The returns shown in the chart above show the volatility that investors may face when chasing performance. The biggest winner of the 1990s (the MSCI EAFE Index) has lagged other indices since the 1990s, and the winners during the 1990s (e.g., the S&P 500 indices and the Nasdaq Composite) have substantially lagged during the 2000s (up through 2008). I can only speculate as to which indices will outperform during the coming decades. However, I would bet that Small Cap Value stocks will continue to outperform other indices over long periods of time.

The chart below (click on the chart for a larger view) illustrates decade-by-decade returns for various stock and bond indices during the 1980s, 1990s, and 2000s (through 2008). The chart below illuistrates returns for small cap indices (Russell 2000, Russell 2000 Value, and Russell 2000 Growth), large cap indices (S&P 500, S&P/Citi 500 Value*, and S&P/Citi 500 Growth*), a broad-based foreign stock index (the Morgan Stanley Capital International Index for the developed stock markets of Europe, Australasia, and the Far East ("MSCI EAFE index")), an index of bonds (Lehman Brothers Aggregate Bond Index ("LB Agg.")), and the Nasdaq Composite Index.

Only three of the indices tracked have provided positive returns for each decade since the 1980s: the Russell 2000 Value, Russell 2000, and LB Agg. The Russell 2000 Value provided annualized returns of 17.44% during the 1980s, 12.45% during the 1990s, and 6.98% so far in the 2000s.

Only three of the indices tracked have provided positive returns for each decade since the 1980s: the Russell 2000 Value, Russell 2000, and LB Agg. The Russell 2000 Value provided annualized returns of 17.44% during the 1980s, 12.45% during the 1990s, and 6.98% so far in the 2000s. As everyone now knows, there was a tremendous stock market bubble which accumulated throughout the 1990s. The Nasdaq Composite was one of the primary beneficiaries of the bubble valuations, rising a whopping annualized 24.5% throughout the 1990s, for a total return of about 794%. Such returns proved to be unsustainable, however, as the Nasdaq Composite has droppjavascript:void(0)ed a total of about 61% since 2000, for an annualized return during the 2000s (through 2008) of -10%.

The MSCI EAFE Index was also the beneficiary of a bubble, although it rose to lofty valuations during the Japan equity bubble of the 1980s. During the 1980s, the MSCI EAFE Index rose an impressive 630%, or about 22% on an annualized basis. Returns during the 1990s were far worse, with the MSCI EAFE Index rising only 96.99%, or about 7% per year. The MSCI has provided negative returns during the 2000s, dropping a total of 14.71%, or about 1.75% per year.

The S&P 500 Index provided strong and steady returns during the 1980s and 1990s until the U.S. stock market bubble burst in 2000. The S&P 500 Index returned about 403% during the 1980s and an additional 432% during the 1990s, for annualized returns during those decades of about 17.5% and 18.2%, respectively. The 2000s, however, have been far worse, with the index dropping 28% so far through 2008, for an annualized return of about -3.6%.

The returns shown in the chart above show the volatility that investors may face when chasing performance. The biggest winner of the 1990s (the MSCI EAFE Index) has lagged other indices since the 1990s, and the winners during the 1990s (e.g., the S&P 500 indices and the Nasdaq Composite) have substantially lagged during the 2000s (up through 2008). I can only speculate as to which indices will outperform during the coming decades. However, I would bet that Small Cap Value stocks will continue to outperform other indices over long periods of time.

Friday, January 30, 2009

1980 - 2008 Stock Market Returns for Various Indices

In 2007 and 2008, I posted charts of the annual stock market and bond market returns for various indices for the time periods from 1980-2006 and 1980-2007, respectively. The charts I previously posted included returns for small cap indices (Russell 2000, Russell 2000 Value, and Russell 2000 Growth), large cap indices (S&P 500, S&P/Citi 500 Value, and S&P/Citi 500 Growth), a broad-based foreign stock index(Morgan Stanley Capital International Index for the developed stock markets of Europe, Australasia, and the Far East ("MSCI EAFE index")), an index of bonds (Lehman Brothers Aggregate Bond Index ("LB Agg.")), and the Nasdaq Composite Index. I have updated the chart (click on the image for a larger view) to reflect returns for 2008.

2008 was an awful year for stock indices, providing the worst calendar year returns since the 1930s. Despite the horrible 2008 returns, all of the indices tracked in the chart below have provided returns far in excess of inflation since 1980 (inflation has averaged somewhere between 3 and 4 percent since 1980). The Russell 2000 Value index has outperformed all other investment styles over the time frame, returning 2864%, which is an average annual return of about 12.40%. This is total return is especially impressive when one considers that Small Cap Value stocks lost over 28% in 2008. The overall formidable return of the Russell 2000 Value index is to be expected, given that Small Cap Value stocks have routinely outperformed other investment styles over long periods of time as I have previously discussed.

The Russell 2000 Growth Index is the worst performer since 1980, providing a total return of just 582% over the time period, or about 6.85% per year. The returns for Small Cap Growth stocks have been very poor since the 1980s and I question whether a return of just 2-3% above inflation since the 1980s is an adequate return for the excess risk involved in holding Small Cap Value stocks.

The S&P 500 Index dropped 37% - the index had its worst calendar year return since it was created in 1957. Including the S&P 90 Index, the predecessor to the S&P 500 index, the last time that a diversified large cap U.S. index dropped this much was in 1934, when the S&P 90 dropped over 43%.

Tech stocks also took a beating in 2008, as evidenced by the 40% drop in the Nasdaq Composite Index. That is the worst calendar year performance for the Nasdaq Composite since it was created in 1971.

International stocks were the worst performers of all of the indices I tracked last year, with the MSCI EAFE Index dropping over 43% after several years of impressive returns. The MSCI EAFE Index broke its 6-year winning streak over the S&P 500 Index in 2008. However, I suspect that international stocks will soon outperform U.S. stocks again, given that the U.S. runs an enormous trade deficit with the rest of the world and the U.S. dollar will inevitably weaken.

The only index providing a positive return was the LB Agg.**, which tracks U.S. government, corporate, and mortgage-backed securities with maturities of at least one year. The LB Agg. rose about 5.24% in 2008. Since 1980, the LB Agg. has provided annualized returns of about 8.88%, despite exhibiting far less volatility than the other stock market indices tracked in the chart below.

* I acquired most of the returns in this chart from old versions of the Callan "Periodic Table" of investment returns.

** The LB Agg. bong index has since been renamed the Barclays Capital Aggregate Bond Index ("BC Agg.").

*** Edit - January 2, 2017 ***

I have updated this chart with results through 2016.

2008 was an awful year for stock indices, providing the worst calendar year returns since the 1930s. Despite the horrible 2008 returns, all of the indices tracked in the chart below have provided returns far in excess of inflation since 1980 (inflation has averaged somewhere between 3 and 4 percent since 1980). The Russell 2000 Value index has outperformed all other investment styles over the time frame, returning 2864%, which is an average annual return of about 12.40%. This is total return is especially impressive when one considers that Small Cap Value stocks lost over 28% in 2008. The overall formidable return of the Russell 2000 Value index is to be expected, given that Small Cap Value stocks have routinely outperformed other investment styles over long periods of time as I have previously discussed.

The Russell 2000 Growth Index is the worst performer since 1980, providing a total return of just 582% over the time period, or about 6.85% per year. The returns for Small Cap Growth stocks have been very poor since the 1980s and I question whether a return of just 2-3% above inflation since the 1980s is an adequate return for the excess risk involved in holding Small Cap Value stocks.

The S&P 500 Index dropped 37% - the index had its worst calendar year return since it was created in 1957. Including the S&P 90 Index, the predecessor to the S&P 500 index, the last time that a diversified large cap U.S. index dropped this much was in 1934, when the S&P 90 dropped over 43%.

Tech stocks also took a beating in 2008, as evidenced by the 40% drop in the Nasdaq Composite Index. That is the worst calendar year performance for the Nasdaq Composite since it was created in 1971.

International stocks were the worst performers of all of the indices I tracked last year, with the MSCI EAFE Index dropping over 43% after several years of impressive returns. The MSCI EAFE Index broke its 6-year winning streak over the S&P 500 Index in 2008. However, I suspect that international stocks will soon outperform U.S. stocks again, given that the U.S. runs an enormous trade deficit with the rest of the world and the U.S. dollar will inevitably weaken.

The only index providing a positive return was the LB Agg.**, which tracks U.S. government, corporate, and mortgage-backed securities with maturities of at least one year. The LB Agg. rose about 5.24% in 2008. Since 1980, the LB Agg. has provided annualized returns of about 8.88%, despite exhibiting far less volatility than the other stock market indices tracked in the chart below.

* I acquired most of the returns in this chart from old versions of the Callan "Periodic Table" of investment returns.

** The LB Agg. bong index has since been renamed the Barclays Capital Aggregate Bond Index ("BC Agg.").

*** Edit - January 2, 2017 ***

I have updated this chart with results through 2016.

Thursday, January 22, 2009

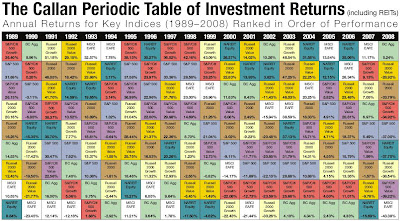

Updated "Periodic Table" of Equity Style Investment Returns Through 2008

An updated version of the Callan "Periodic Table" of equity style investment returns from 1989-2008 is posted below. (Click on the image below to see a larger version of the Periodic Table.) This Periodic Table illustrates calendar year returns for several indices, including the S&P 500, S&P/Citigroup 500 Growth, S&P 500/Citigroup 500 Value, Russell 2000, Russell 2000 Value, Russell 2000 Growth, MSCI EAFE, BC Agg bond, and NAREIT Equity REIT.

This chart was originally posted on the website for Callan Associates.

This chart was originally posted on the website for Callan Associates.

Subscribe to:

Posts (Atom)