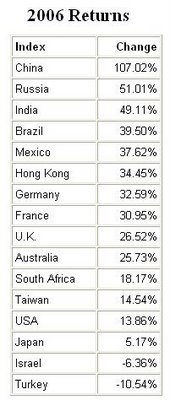

Thursday, January 04, 2007

2006 Global Stock Market Returns

Wednesday, January 03, 2007

The First BRIC ETF Was Launched In September

I have been waiting for an ETF to be introduced that invests only in the BRIC countries. Unfortunately there was none until very recently. The best that a small investor could do was to purchase a broad-based emerging markets ETF such as the iShares MSCI Emerging Markets Index Fund ("EEM") that invests in the BRIC countries as well as many other countries, including South Korea and Taiwan. Alternatively, one could also invest in country-specific ETFs and closed-end funds, such as the iShares MSCI Brazil Index Fund ("EWZ"), iShares FTSE/Xinhua China 25 Index Fund ("FXI"), Templeton Russia & East European Fund ("TRF"), and Morgan Stanley India Investment Fund ("IIF").

Luckily, the first BRIC ETF has finally been introduced. During mid-September 2006, the Claymore BRIC ETF was unveiled. The Claymore BRIC ETF invests solely in the BRIC countries and tracks the Bank of New York's BRIC Select ADR Index. Unfortunately, the BRIC ETF does not invest evenly in the BRIC countries - about 48% of the assets are in Brazil, 31% in China, close to 14% in India, but just 6% in Russia. Moreover, the ETF's assets are highly concentrated among a handful of stocks - the ETF owns both common and preferred shares of the Brazilian company Petroleo Brasileiro (symbol: PBR) totaling 15.53% of the ETF's net assets.

Although I am glad to finally see a BRIC ETF, I'm going to sit on the sidelines. I don't like the uneven investment in the BRIC countries, with the investment in Brazilian companies being nearly eight times as large as the investment in Russian stocks. For the time being, I will continue to invest in EEM and the country-specific ETFs and country-specific closed-end funds I listed above.

Monday, January 01, 2007

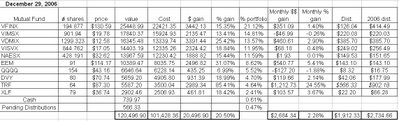

December 2006 Returns For My Model Long-Term Portfolio

Emerging markets led the way in December and were the overall winners in my portfolio for the 2006-year. The Templeton Russia closed-end fund (TRF) rose over 24% in December and finished 2006 up a whopping 85%, and the iShares Emerging Markets ETF (EEM) returned about 5.4%, finishing the year up just over 31%. My third-best performer in 2006 was the Vanguard Developed Markets Index mutual fund (VDMIX), which rose about 2.9% in December and finished 2006 up about 25.4%. Dividend-paying stocks also performed well during December, with S&P 500 Financial components ETF (XLF) returning about 3.6% and the iShares Dow Jones U.S. Select Dividend Index Fund (DVY) rising about 2.1%.

As discussed above, the foreign holdings (i.e., TRF, EEM, and VDMIX) powered the portfolio during 2006. The only real dog of the portfolio was the Nasdaq 100 ETF (QQQQ), which rose just under 7% during 2006, trailing the overall performance of the portfolio by about 13.5%.

Nine of the ten holdings in the portfolio paid distributions during December. TRF was the only holding to not pay a distribution. However, distributions were deducted from the share price for TRF at the end of December. The TRF distributions will be paid out during the middle of January. Because the distribution is large (greater than $500), I have included the January 2007 TRF distributions in the December 2006 returns for TRF and labeled them "pending distributions."

Regarding the rest of the holdings, the dividends from mutual fund holdings were reinvested, but the dividends from the ETFs were not reinvested- they were accumulated as "CASH" on the performance table below, for the reasons set forth in a previous post. The Vanguard S&P 500 Index fund (VFINX) paid a dividend of $0.65/share (a total of $126.04), which was reinvested on December 27th to purchase an additional 0.966 shares at a price of $130.43/share. The Vanguard Mid Cap Index Fund (VIMSX) paid a dividend of $0.247/share (a total of $220.03), which was reinvested on December 22nd to purchase an additional 11.135 shares at a price of $19.76/share. The Vanguard Developed Markets Index mutual fund (VDMIX) paid a dividend of $0.299/share and a short-term capital gain of $0.005/share (a total of $385.70), which was reinvested on December 29th to purchase an additional 30.563 shares at a price of $12.62/share. The Vanguard Small Cap Value Index (VISVX) paid a dividend of $0.30/share (a total of $249.02), which was reinvested on December 22nd to purchase an additional 14.709 shares at a price of $16.93/share. The Vanguard Small Cap Index (NAESX) paid a dividend of $0.353/share (a total of $149.53), which was reinvested on December 22nd to purchase an additional 4.604 shares at a price of $32.48/share.

The ETFs listed below each paid a distribution that was invested in "CASH" as shown in the chart below. EEM paid a dividend of $1.57251/share (a total of $143.10) on December 29th. QQQQ paid a dividend of $0.054/share (a total of $8.32) on December 29th. DVY paid a dividend of $0.52572/share (a total of $42.06) on December 27th. XLF paid a dividend of $0.28103/share (a total of $22.20) on December 27th. Finally, a distribution of $8.8489 was deducted from the TRF share price on December 27th and will be paid on January 16, 2006.

My Hypothetical Model Portfolio beat the S&P 500 index by about 5 percentage points during 2006. This is an impressive performance. I concede that the Hypothetical Model Portfolio will underperform the S&P 500 index from time-to-time, but it should outperform the S&P 500 index over the long-term. For the 2007 investing year, I intend to add another $25,000 to the Hypothetical Model Portfolio and invest this money and the money listed as "CASH" below according to the same allocations as were outlined in my original post in which I introduced my Hypothetical Model Portfolio. I will discuss the purchase of new shares in a subsequent post.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

November 2006 Returns

Thursday, December 14, 2006

The U.S. Mint Is Implementing A New Rule Abolishing the Melting of Pennies and Nickels

The value of the metals within several U.S. coins, including pennies and nickels, now exceeds the face value of the coins, as shown in the picture below that I acquired from coinflation.com, the best website I've seen for determining the intrinsic metal of various coins (click on the picture for a larger view). As one can see, the metal value of pre-1982 pennies is now 2.0752 cents (207.52% of face value), post-1982 zinc pennies have a metal value of 1.1257 cents (112.57% of face value), and nickels have a metal value of 6.9879 cents (139.75% of face value).

To realize the intrinsic metal value of these coins, one would need to melt them down to separate out the respective valuable metals. Up until yesterday, my understanding was that this practice was not illegal. I've never done so myself or heard of anyone actually doing so, but I read somewhere that this practice would not be prohibited.

The U.S. Mint has apparently been losing money by making pennies and nickels over the past year as it pays more for the metals used to make the coins that it receives in return when it sells the coins at face value to banks, etc. As of today, the U.S. Mint has made it illegal to melt down pennies and nickels. It is also illegal to transport more than $100 worth of pennies and/or nickels out of the country unless it is for legitimate coinage purposes. The penalty for violation of this new rule is a penalty of up to five years in prison and a fine of up to $10,000 for people convicted of violating the rule.

In case anyone had any doubts about whether collecting pennies and nickels is worthwhile, the U.S. Mint's implementation of the new rule should quell such doubts. It's only a matter of time until the U.S. Mint changes the metal composition of pennies and nickels to include less expensive metals, a move that would likely increase the collectible value of current pennies and nickels.

Thursday, December 07, 2006

November 2006 Returns For My Model Long-Term Portfolio

Emerging markets led the way in November, with the Templeton Russia closed-end fund (TRF)appreciating about 13.86% and the iShares Emerging Markets ETF (EEM) returning about 5.98%. Mid caps, small caps, and tech stocks were also strong performers. The Vanguard Mid Cap Index (VIMSX), the Vanguard Small Cap Index (NAESX), Vanguard Small Cap Value Index (VISVX), and the Nasdaq 100 ETF (QQQQ) rose 3.83%, 3.04%, 3.10%, and 3.43%, respectively. The only other ETF or fund to return more than 3% in November was the Vanguard Developed Markets Index mutual fund (VDMIX), which returned about 3.83%. (VDMIX tracks the broad-based foreign stock MSCI EAFE index.)

The poorest portfolio performers in November were my holdings that invest in stocks of large cap companies and dividend-focused ETFs. The Vanguard Index 500 fund (VFINX), S&P 500 Financial components ETF (XLF), and iShares Dow Jones U.S. Select Dividend Index Fund (DVY) returned 1.88%, 1.63%, and 0.71%, respectively.

The stock market continues to look strong as 2006 comes to an end. With a slight surge in December, my Hypothetical Model Portfolio can close the year up 20%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

October 2006 Returns

Thursday, November 16, 2006

Home Depot Is Raising Its Dividend By 50% For The Second Time During 2006

I wrote a post back in February where I argued that Home Depot is a "strong buy." I still believe that Home Depot is a good-long term buy. It may not perform well over the short term, but as its earnings and dividends continue to rise Wall Street will eventually take notice and bid its shares higher like it did during the 90s. The Value Line projects that Home Depot will trade between $95 and $125/share between 2009-2011, a gain of between about 160% and 245%.

Sunday, November 12, 2006

Best Posts Over The Past Year

Best posts relating to Stock Market Investing:

(1) Selling stocks short

(2) Historical Dividends for the S&P 500

(3) The "FED Model" theory of equity valuation

(4) The MSCI EAFE index is the "S&P 500" of foreign stocks

(5) Small Cap Value stocks outperform Large Cap Growth stocks

(6) "Periodic Table" of Equity Style Investment Returns for 1986-2005

(7) Investing In Growth Stocks Is Not For The Faint Of Heart

(8) Criticisms of Dollar-Cost Averaging Investment Strategies Are Unjustified

(9) Stock Market Styles Are Very Cyclical

(10) Think Twice Before Investing In Companies That Manufacture Memory Devices Or Other Electronic "Commodities"

(11) The Templeton Russia & East European Fund

(12) Closed-end funds are the best way for the common man to invest in Russia and India

(13) Wal-Mart's Stock Valuation Looks Compelling

Best posts relating to Coin Collecting:

(1) Save Your Pre-1982 Pennies

(2) With Commodities Are Soaring, I am Saving Nickels and Pre-1982 Pennies

(3) I'm Still Saving U.S. Nickel Coins

Best posts relating to Miscellaneous Personal Finance Issues:

(1) "Revolt of the Fairly Rich"

(2) Robert Kiyosaki Has Written Another Flimsy Article For Yahoo Finance

(3) Everbank Provides An Easy Way To Speculate In Foreign Currency And Precious Metals

Wednesday, November 08, 2006

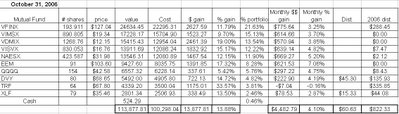

October 2006 Returns For My Model Long-Term Portfolio

The iShares Emerging Markets ETF (EEM) led the portfolio higher, returning 7.06% for the month. Small caps and tech stocks were also strong performers. The Vanguard Small Cap Index (NAESX), Vanguard Small Cap Value Index (VISVX), and Nasdaq 100 ETF (QQQQ) rose 5.20%, 4,82%, and 4.75%, respectively.

The only laggards during October were the S&P 500 Financial components ETF (XLF) and the Templeton Russia closed-end fund (TRF) , returning 2.87% and losing 0.16%, respectively.

Two of my holdings paid dividends during October. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. The iShares Dow Jones U.S. Select Dividend Index Fund (DVY) paid a dividend of $0.5662 (a total of $45.30 ), and XLF paid a dividend of $0.194/share (a total of $15.33).

Stocks look good heading toward the end of 2006. With a strong finish during November and December, my Hypothetical Model Portfolio could close the year up 15-20%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.

September 2006 Returns

Thursday, November 02, 2006

Fidelity's Magellan Fund Is Being Routed By Its Benchmark Index

Unfortunately, Magellan's performance has lagged for the past 10+ years due to bad investments by its managers. Its huge size has also been a hindrance, as enormous growth-oriented mutual funds have difficulty closing positions in growth stocks without adversely affecting the price of stocks it is selling.

According to this recent article in Fortune magazine, Magellan is currently mired in its second-worst performance slump relative to the S&P 500 index in 30 years.

Friday, October 27, 2006

"Revolt of the Fairly Rich"

According to Fortune some of the "lower uppers" are doctors, accountants, engineers, and lawyers, and these successful people work very hard are are somewhat jealous of the "high uppers" who are perceived as sometimes making 10 times as much money without working 10 times as hard as do they.

I personally think that this alleged resentment is overblown. It is true that some of those professionals who are lower uppers are jealous to a certain extent that people at the high end make so much more money. However, I don't see an impending revolt anytime soon. Many professionals are in highly competitive and stressful businesses/industries and they often feel as though they are not being paid what they are worth. Even though they might not be making as much as the person next door, they certainly must realize that in the grand scheme of things they do have it pretty good.

Thursday, October 26, 2006

LSI Logic Finally Delivers!

I accumulated my LSI position over a period of 2 years, buying shares periodically on dips between October 2002 and July 2004. My average cost basis is $6/share and I have been waiting for LSI to break above $12 so that I can sell my shares and realize a 100+% gain.

LSI closed at $8 on the last trading day in December 2005. It rose to $11.81 on March 31st, but has floundered since then, dropping down below $8, with its lowest close occurring on August 25th, when it closed at $7.46/share.

LSI reported its earnings for its 3rd fiscal quarter yesterday. I expected them to be lackluster, but I was pleasantly surprised. The Street was expecting earnings of 12 cents per share, and LSI reported non-GAAP earnings of 16 cents per share. LSI also provided decent guidance for the upcoming quarter. Wall Street took notice and has bid LSI higher by about 16% today, up to $9.69/share.

Wednesday, October 25, 2006

Add My Financeandinvestments Blog to My Yahoo!

If you want to add Financeandinvestments.blogspot.com to your My Yahoo! page so that you can see my most recent posts about stocks and personal finance, all you need to do is click on the "Add Content" link at the bottom of your My Yahoo! page. On the next page you will need to click on the link entitled "Add RSS by URL" to the right of the displayed "Find Content" box. On the subsequent page, type this URL into the box:

http://financeandinvestments.blogspot.com/rss.xml

Finally, you can click on the link to return to My Yahoo! Once back on the My Yahoo! page, I clicked the "edit" button on the tab for my my blog. I personalized the tab so that the 3 most recent posts are always linked to my My Yahoo! page, regardless of when those posts were created.

Tuesday, October 24, 2006

I'm Still Saving U.S. Nickel Coins

It's a good thing that I've been saving nickels because the value of nickel and copper has soared since April. One pound of nickel is now worth $15.4909, nearly twice what it was a mere 6 months ago. Copper has risen a slightly less impressive 31%, with one pound of copper now trading for $3.4302 per pound. The melt value of U.S. nickel coins is now about 7.10471 cents, or 142.09% of its 5 cent face value. The melt value of U.S. nickel coins has therefore risen about 67% since April.

If the value of copper and nickel remains strong, it's only a matter of time until everyone starts hoarding U.S. nickel coins, just like the U.S. population did in the 1960 when quarters used to be made of silver and the price of silver rose so much that the value of the silver in quarters exceeded the 25-cent face value of the quarters. Accordingly, I continue to recommend that people saved their nickels.

FYI, numismatic news has a great article about hording coins.

Friday, October 13, 2006

Interesting Website With Information About Dow Jones Indices

Monday, October 02, 2006

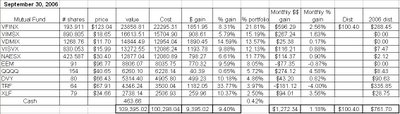

September 2006 Returns For My Model Long-Term Portfolio

The portfolio was strong throughout the month. Tech stocks led the way for the second straight moneth, with the Nasdaq 100 ETF (QQQQ) rising 4.58%. The second biggest winner (on a percentage basis) was the S&P 500 Financial components ETF (XLF), which appreciated by 3.56%. Large cap stocks also performed very well - the Vanguard S&P 500 Index fund (VFINX) rose about 2.56%.

Small caps and international stocks were laggards during September, possibly due to a stronger U.S. dollar. The Templeton Russia closed-end fund (TRF) and

the iShares Emerging Markets ETF (EEM) both posted negative returns, falling about 4.00% and 0.87%, respectively. Other dogs include the Vanguard Developed Markets Index fund (VDMIX), the Vanguard Small Cap Value Index (VISVX), and the Vanguard Small Cap Index (NAESX) which rose just 0.17%, 0.88%, and 0.90%, respectively.

One of the holdings in my Hypothetical Model Portfolio, VFINX, paid dividends during Septmember. As I mentioned in a previous post, the dividends from mutual fund holdings are reinvested, but the dividends from ETFs or the closed end fund (i.e., the Templeton Russia closed-end fund (TRF)) are not reinvested- they will accumulate as "CASH" on the performance table below. VFINX paid a dividend of $0.52/share (a total of $100.40) which was reinvested on September 22 to purchase an additional 0.829 shares at a price of $121.08/share.

I was glad to see decent returns in August. Hopefully stocks will perform well during the 4th quarter of 2006 so that my Hypothetical Model Portfolio will end 2006 up 10-15%.

*The Hypothetical Model Portfolio was hypothetically created with an investment of $100,000 with investments made as of the closing values on December 30, 2005. The reason why the total cost in the chart is greater than $100,000 is because the total cost accounts for the value of dividends reinvested into the mutual funds in the portfolio.